Question: What is the current situation? By using financial strategy matrix Hawawini & Viallet (2002:525) which quadrant it belong and comment why Sengupta Fibres Ltd (Bruner

What is the current situation? By using financial strategy matrix Hawawini & Viallet (2002:525) which quadrant it belong and comment why Sengupta Fibres Ltd (Bruner 1999:118-132) is doing the wrong things.

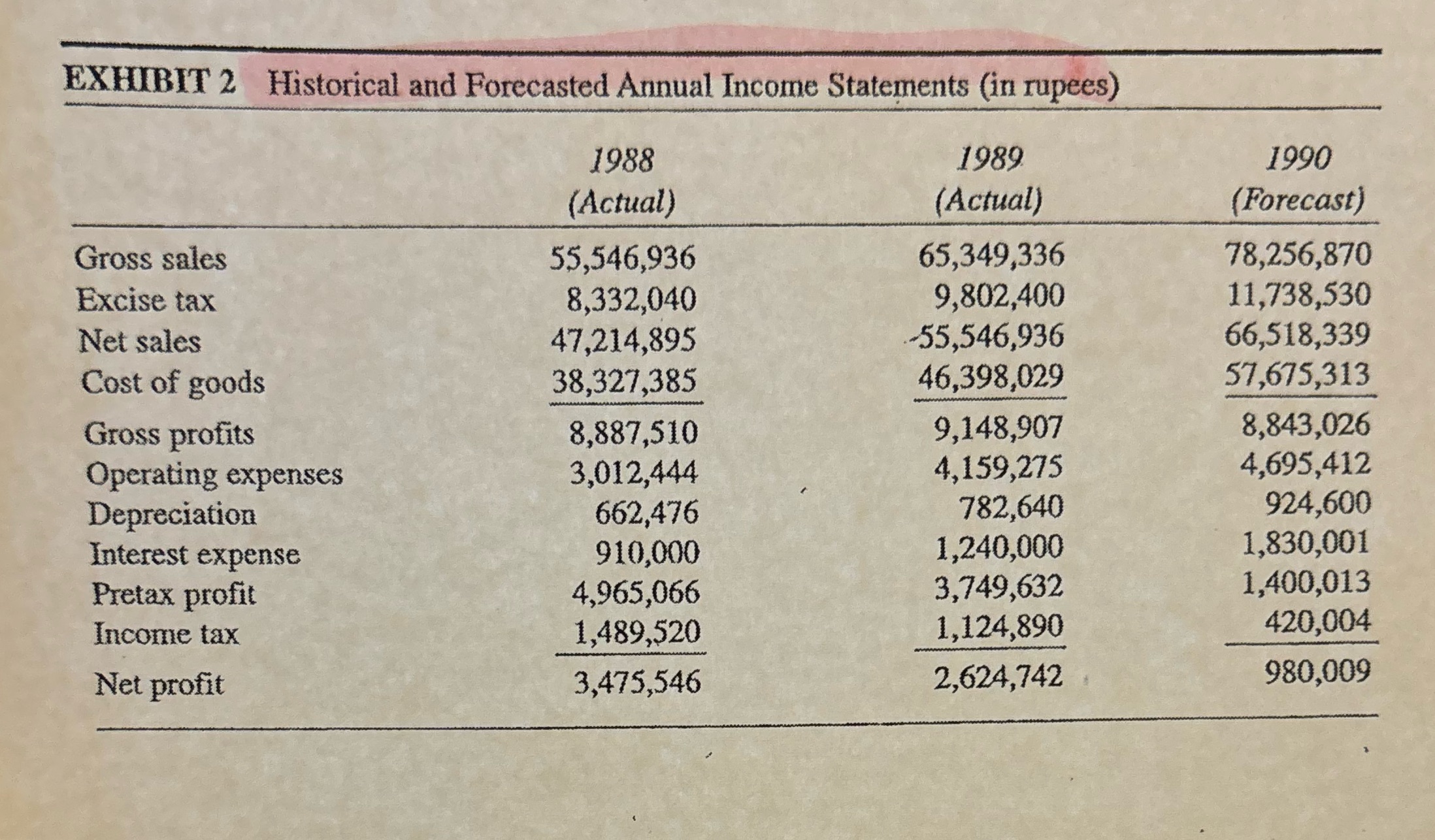

EXHIBIT 2 Historical and Forecasted Annual Income Statements (in rupees) 1988 1989 1990 (Actual) (Actual) (Forecast) Gross sales 55,546,936 65,349,336 78,256,870 Excise tax 8,332,040 9,802,400 11,738,530 Net sales 47,214,895 -55,546,936 66,518,339 Cost of goods 38,327,385 46,398,029 57,675,313 Gross profits 8,887,510 9,148,907 8,843,026 Operating expenses 3,012,444 4,159,275 4,695,412 Depreciation 662,476 782,640 924,600 Interest expense 910,000 1,240,000 1,830,001 Pretax profit 4,965,066 3,749,632 1,400,013 Income tax 1,489,520 1,124,890 420,004 Net profit 3,475,546 2,624,742 980,009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts