Question: What is the current yield for a bond that has a coupon rate of 9.3% paid annually, a par value of $1000, and 19 years

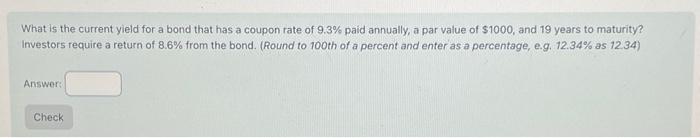

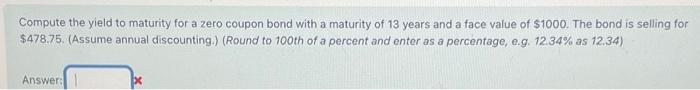

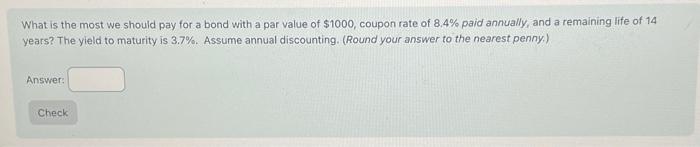

What is the current yield for a bond that has a coupon rate of 9.3% paid annually, a par value of $1000, and 19 years to maturity? Investors require a return of 8.6% from the bond. (Round to 100 th of a percent and enter as a percentage, e.g. 12.34\% as 12.34) Answer: Compute the yield to maturity for a zero coupon bond with a maturity of 13 years and a face value of $1000. The bond is selling for $478.75. (Assume annual discounting.) (Round to 100 th of a percent and enter as a percentage, e.g. 12.34\% as 12.34) Answer: What is the most we should pay for a bond with a par value of $1000, coupon rate of 8.4% paid annually, and a remaining life of 14 years? The yield to maturity is 3.7%. Assume annual discounting. (Round your answer to the nearest penny.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts