Question: What is the depreciation expense for the first year using the straight-line method? Belmont Kookies, Inc. acquired an oven for its baking operations on March

What is the depreciation expense for the first year using the straight-line method?

What is the depreciation expense for the first year using the straight-line method?

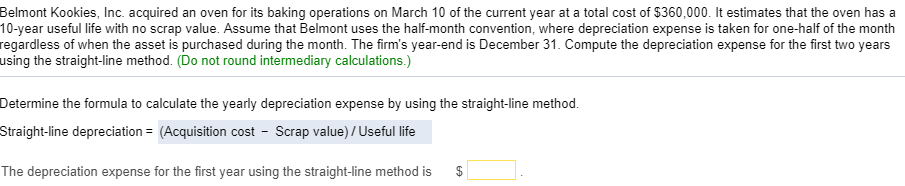

Belmont Kookies, Inc. acquired an oven for its baking operations on March 10 of the current year at a total cost of $360,000. It estimates that the oven has a 10-year useful life with no scrap value. Assume that Belmont uses the half-month convention, where depreciation expense is taken for one-half of the month regardless of when the asset is purchased during the month. The firm's year-end is December 31. Compute the depreciation expense for the first two years using the straight-line method. (Do not round intermediary calculations.) Determine the formula to calculate the yearly depreciation expense by using the straight-line method. Straight-line depreciation (Acquisition cost - Scrap value)/Useful life The depreciation expense for the first year using the straight-line method is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts