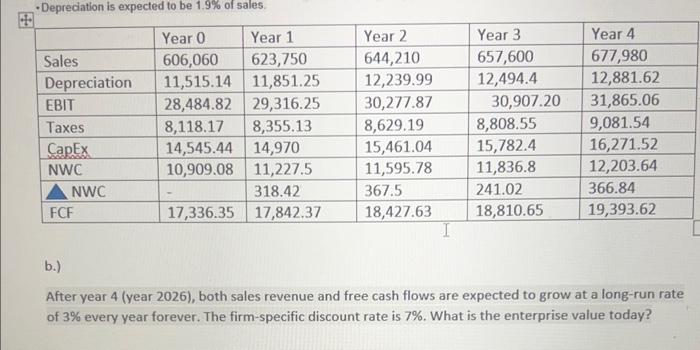

Question: What is the enterpise value here ? - Depreciation is expected to be 1.9% of sales. b.) After year 4 (year 2026), both sales revenue

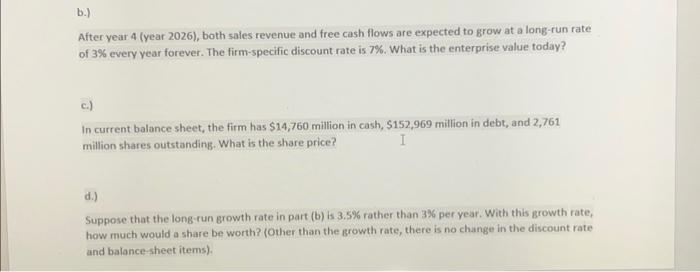

- Depreciation is expected to be 1.9% of sales. b.) After year 4 (year 2026), both sales revenue and free cash flows are expected to grow at a long-run rate of 3% every year forever. The firm-specific discount rate is 7%. What is the enterprise value today? After year 4 (year 2026), both sales revenue and free cash flows are expected to grow at a long-run rate of 3% every year forever. The firm-specific discount rate is 7%. What is the enterprise value today? c.) In current balance sheet, the firm has \$14,760 million in cash, \$152,969 million in debt, and 2,761 million shares outstanding. What is the share price? d.) Suppose that the long-run growth rate in part (b) is 3.5% rather than 3% per year. With this growth rate, how much would a share be worth? (Other than the growth rate, there is no change in the discount rate and balance-sheet items)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts