Question: What is the estimated company's worth (per share) using a DCF valuation? Note: Can use some proxy values if needed. Just provide the assumption and

What is the estimated company's worth (per share) using a DCF valuation?

Note: Can use some proxy values if needed. Just provide the assumption and explanation.

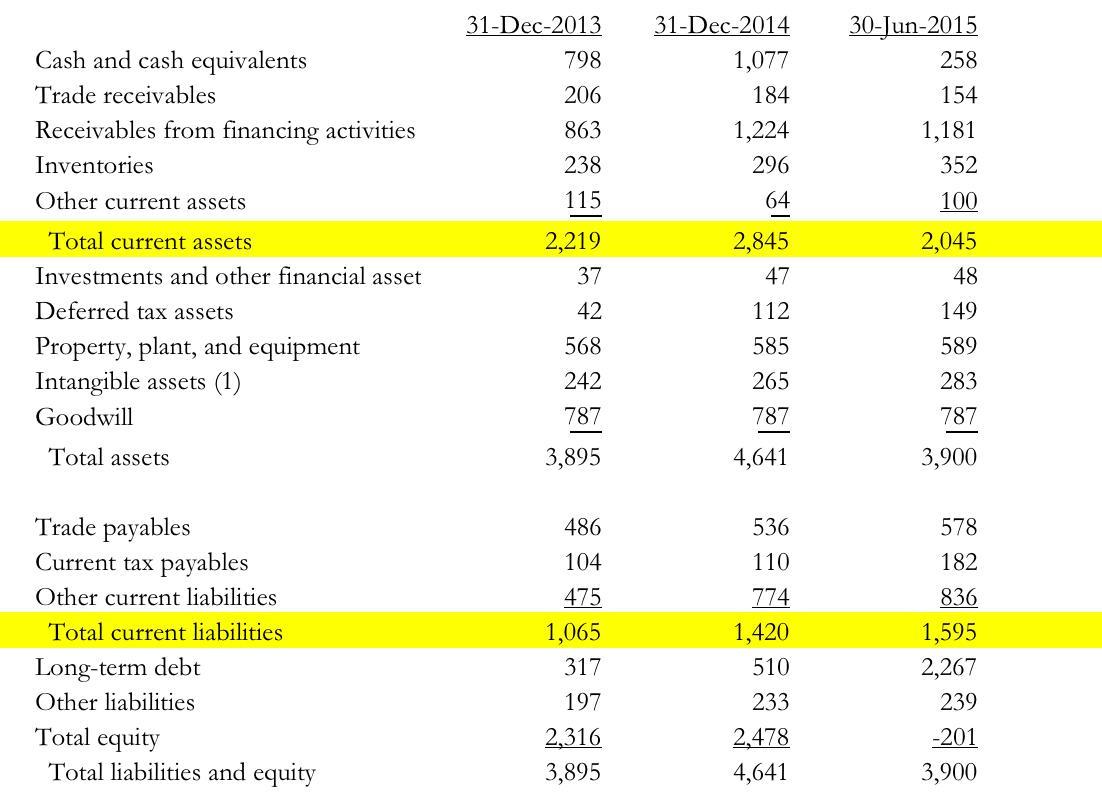

Cash and cash equivalents Trade receivables Receivables from financing activities Inventories Other current assets Total current assets Investments and other financial asset Deferred tax assets Property, plant, and equipment Intangible assets (1) Goodwill Total assets Trade payables Current tax payables Other current liabilities Total current liabilities Long-term debt Other liabilities Total equity Total liabilities and equity 31-Dec-2013 798 206 863 238 115 2,219 37 42 568 242 787 3,895 486 104 475 1,065 317 197 2,316 3,895 31-Dec-2014 1,077 184 1,224 296 64 2,845 47 112 585 265 787 4,641 536 110 774 1,420 510 233 2,478 4,641 30-Jun-2015 258 154 1,181 352 100 2,045 48 149 589 283 787 3,900 578 182 836 1,595 2,267 239 -201 3,900

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

To estimate the companys worth per share using a discounted cash flow DCF valuation I will make the ... View full answer

Get step-by-step solutions from verified subject matter experts