Question: What is the excel formula for year 10 inflow (G30) to equal $131,307 based on the sheet information? begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} hline & A & B &

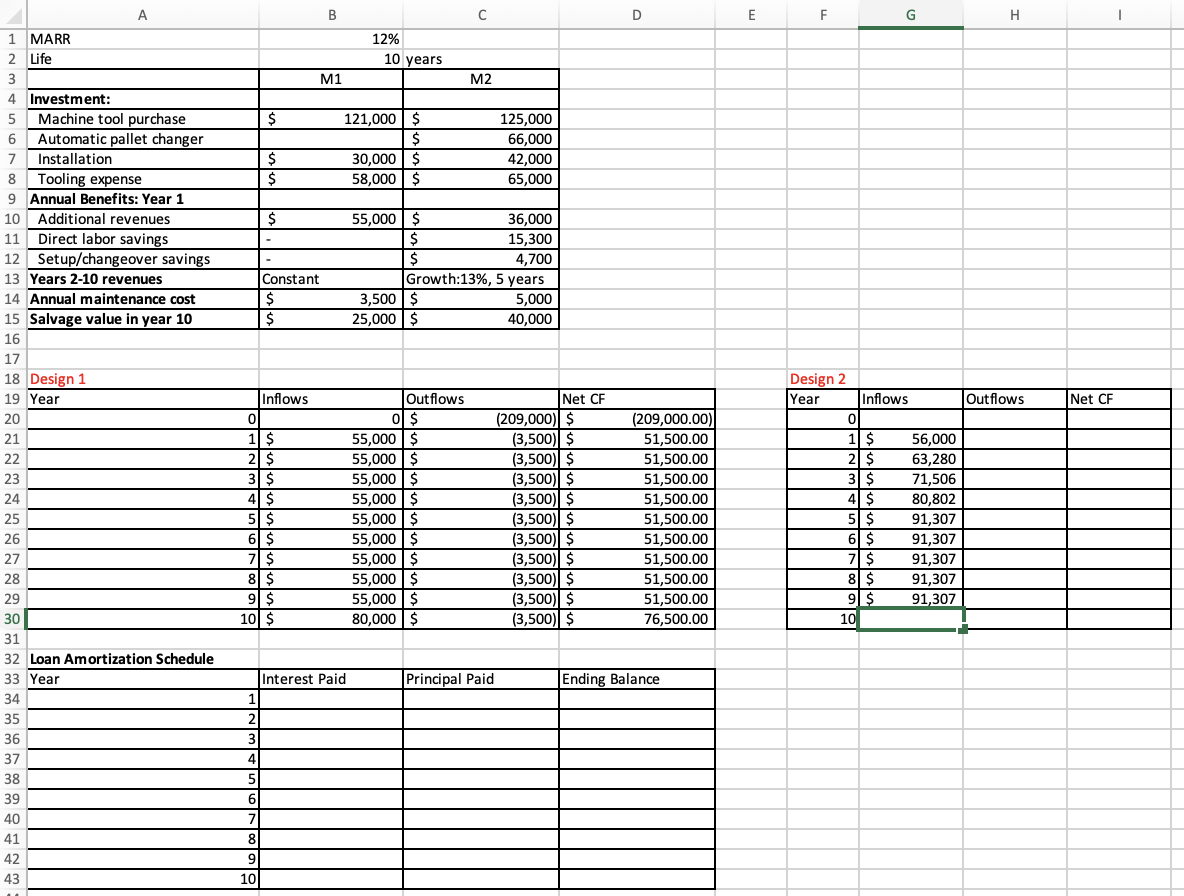

What is the excel formula for year 10 inflow (G30) to equal $131,307 based on the sheet information?

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H & 1 \\ \hline 1 & MARR & 12% & & & & & & & \\ \hline 2 & Life & 10 & years & & & & & & \\ \hline 3 & & M1 & M2 & & & & & & \\ \hline 4 & Investment: & & & & & & & & \\ \hline 5 & Machine tool purchase & 121,000 & 125,000 & & & & & & \\ \hline 6 & Automatic pallet changer & & 66,000 & & & & & & \\ \hline 7 & Installation & 30,000 & 42,000 & & & & & & \\ \hline 8 & Tooling expense & 58,000 & 65,000 & & & & & & \\ \hline 9 & Annual Benefits: Year 1 & & & & & & & & \\ \hline 10 & Additional revenues & 55,000 & 36,000 & & & & & & \\ \hline 11 & Direct labor savings & - & 15,300 & & & & & & \\ \hline 12 & Setup/changeover savings & - & 4,700 & & & & & & \\ \hline 13 & Years 2-10 revenues & Constant & Growth: 13%,5 years & & & & & & \\ \hline 14 & Annual maintenance cost & 3,500 & 5,000 & & & & & & \\ \hline 15 & Salvage value in year 10 & 25,000 & 40,000 & & & & & & \\ \hline 16 & & & & & & & & & \\ \hline 17 & & & & & & & & & \\ \hline 18 & Design 1 & & & & & Design 2 & & & \\ \hline 19 & Year & Inflows & Outflows & Net CF & & Year & Inflows & Outflows & Net CF \\ \hline 20 & 0 & 0 & (209,000) & (209,000.00) & & 0 & & & \\ \hline 21 & 1 & 55,000 & (3,500) & 51,500.00 & & 1 & 56,000 & & \\ \hline 22 & 2 & 55,000 & (3,500) & 51,500.00 & & 2 & 63,280 & & \\ \hline 23 & 3 & 55,000 & (3,500) & 51,500.00 & & 3 & 71,506 & & \\ \hline 24 & 4 & 55,000 & (3,500) & 51,500.00 & & 4 & 80,802 & & \\ \hline 25 & 5 & 55,000 & (3,500) & 51,500.00 & & 5 & 91,307 & & \\ \hline 26 & 6 & 55,000 & (3,500) & 51,500.00 & & 6 & 91,307 & & \\ \hline 27 & 7 & 55,000 & (3,500) & 51,500.00 & & 7 & 91,307 & & \\ \hline 28 & 8 & 55,000 & (3,500) & 51,500.00 & & 8 & 91,307 & & \\ \hline 29 & 9 & 55,000 & (3,500) & 51,500.00 & & 9 & 91,307 & & \\ \hline 30 & 10 & 80,000 & (3,500) & 76,500.00 & & 10 & & & \\ \hline 31 & & & & & & & & & \\ \hline 32 & Loan Amortization Schedule & & & & & & & & \\ \hline 33 & Year & Interest Paid & Principal Paid & Ending Balance & & & & & \\ \hline 34 & 1 & & & & & & & & \\ \hline 35 & 2 & & & & & & & & \\ \hline 36 & 3 & & & & & & & & \\ \hline 37 & 4 & & & & & & & & \\ \hline 38 & 5 & & & & & & & & \\ \hline 39 & 6 & & & & & & & & \\ \hline 40 & 7 & & & & & & & & \\ \hline 41 & 8 & & & & & & & & \\ \hline 42 & 9 & & & & & & & & \\ \hline 43 & 10 & & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts