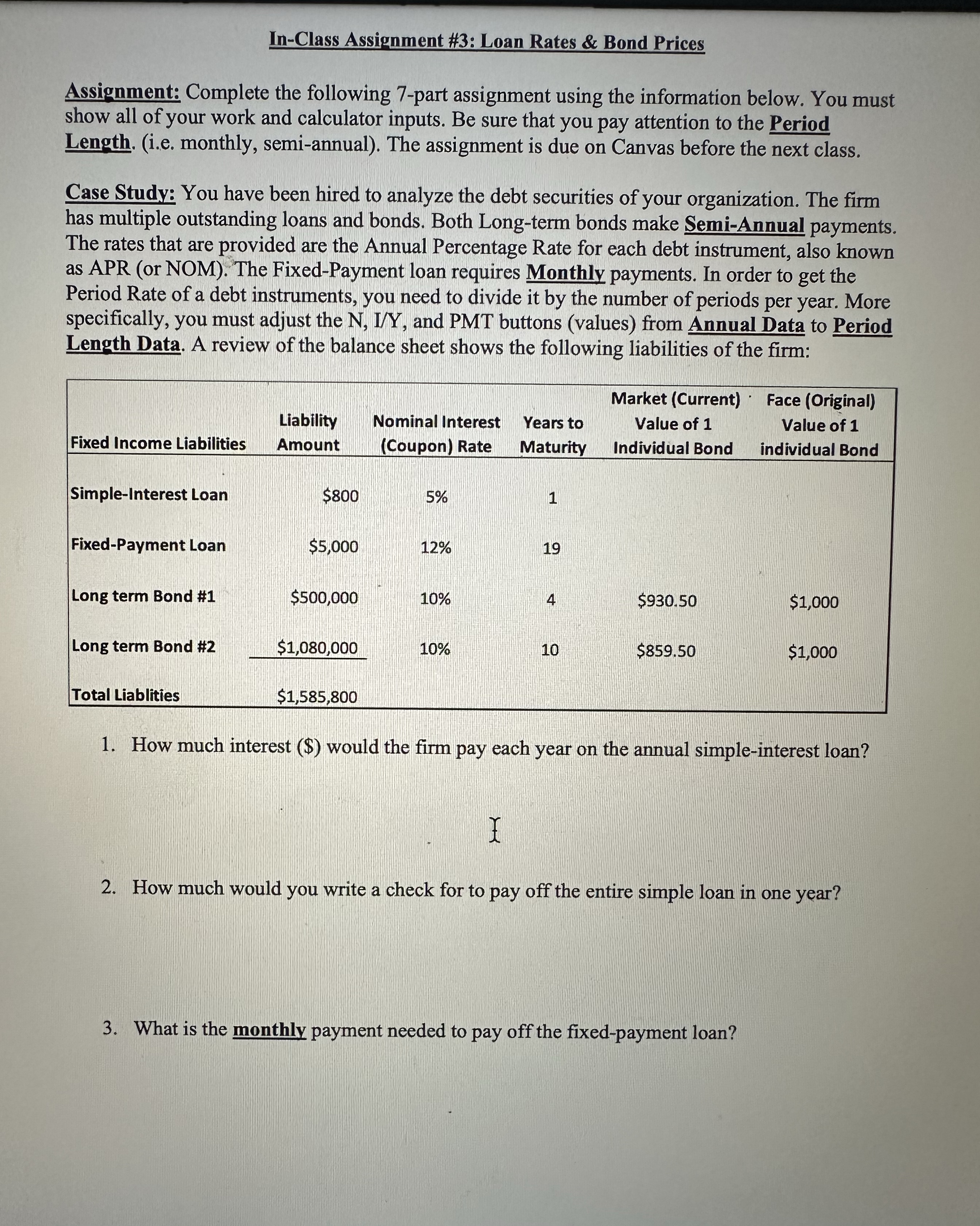

Question: What is the expected annual current yield for each bond if the current price is: a . $ 9 3 0 . 5 0 for

What is the expected annual current yield for each bond if the current price is:

a $ for Bond #

b $ for Bond #

What is the expected annual yield to maturity for each bond? Use TVM

a Bond # selling for $

b Bond # selling for $

What is the annual rate of capital gain if both bonds sell for $ per individual bond exactly one year from today? Be sure to pay attention to if it is a gain or loss

a Bond # selling for $ today?

b Bond # selling for $ today?

Assume Longterm Bond # has years left of Call Protection and offers one extra year's worth of payments as a Call Premium. If you expect interest rates to decline to in years, what is your YieldtoCall?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock