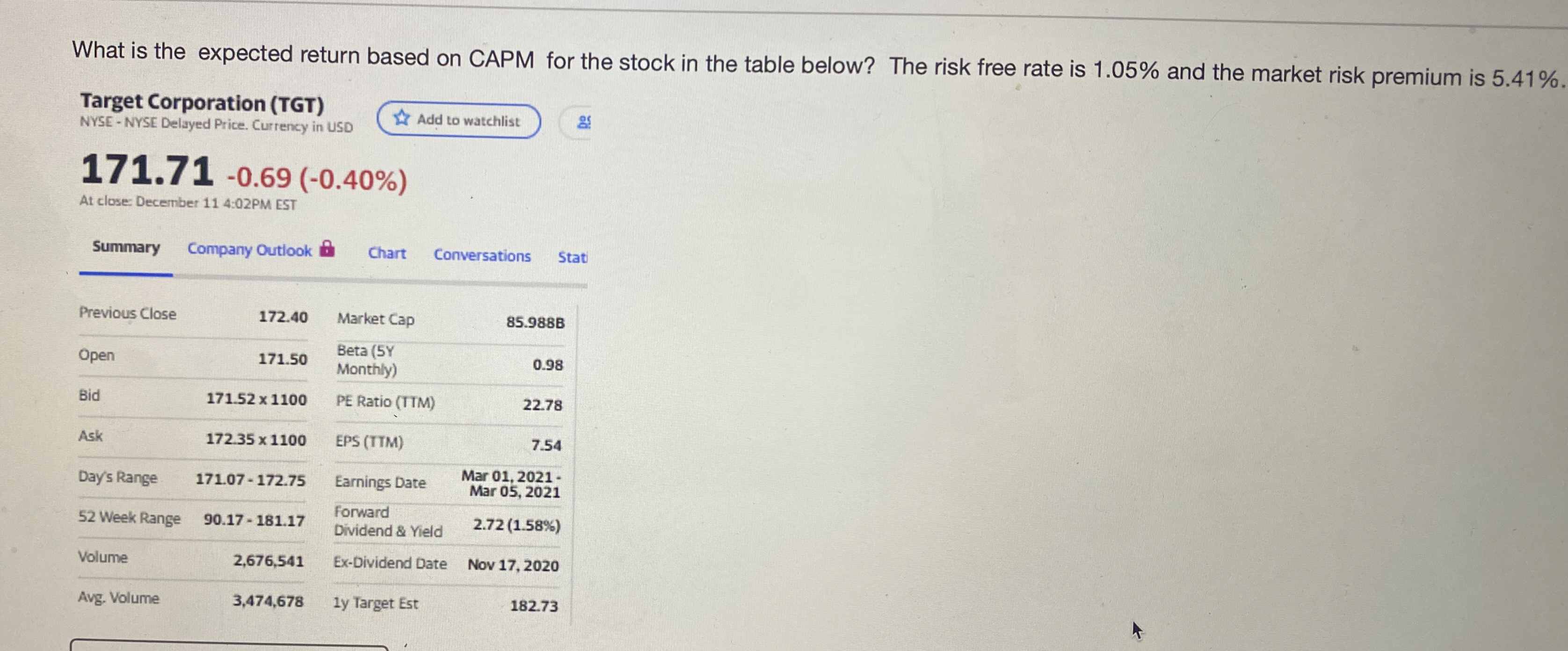

Question: What is the expected return based on CAPM for the stock in the table below? The risk free rate is 1 . 0 5 %

What is the expected return based on CAPM for the stock in the table below? The risk free rate is and the market risk premium is

Target Corporation TGT

NYSENYSE Delayed Price. Currency in USD

At close: Decembet :PM EST

tableSummaryCompany Outlook,Chart,versationsPrevious Close,Market Cap, BOpentableBeta YMonthlyBidPE Ratio TTMAskEPS TTMDays Range,Earnings Date,tableMar Mar Week Range,tableforwardDividend & Yield

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock