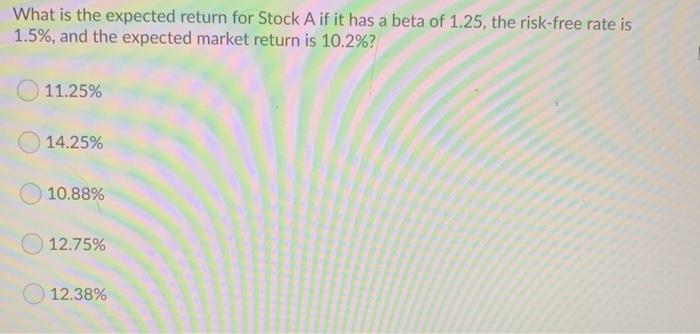

Question: What is the expected return for Stock A if it has a beta of 1.25, the risk-free rate is 1.5%, and the expected market return

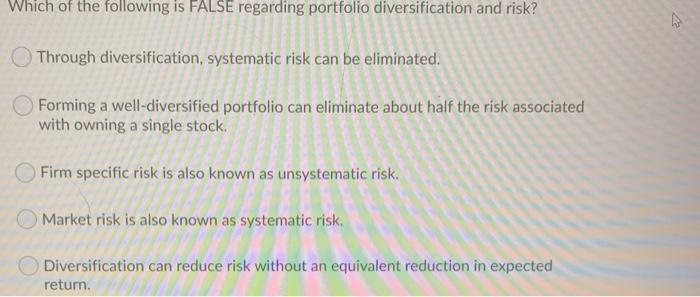

What is the expected return for Stock A if it has a beta of 1.25, the risk-free rate is 1.5%, and the expected market return is 10.2%? 11.25% 14.25% 10.88% 12.75% 12.38% Which of the following is FALSE regarding portfolio diversification and risk? Through diversification, systematic risk can be eliminated. Forming a well-diversified portfolio can eliminate about half the risk associated with owning a single stock. Firm specific risk is also known as unsystematic risk. Market risk is also known as systematic risk. Diversification can reduce risk without an equivalent reduction in expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts