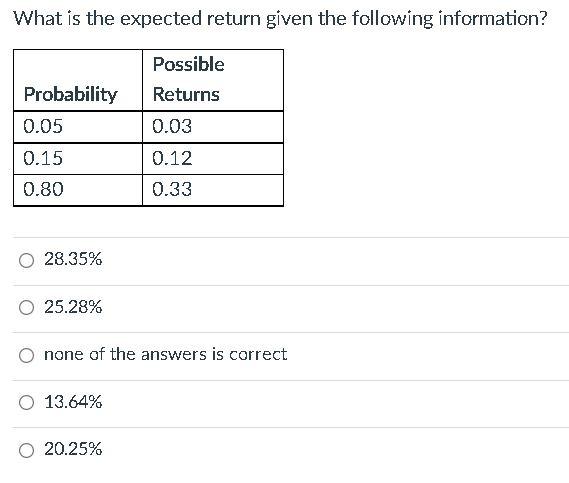

Question: What is the expected return given the following information? Possible Probability Returns 0.05 0.03 0.15 0.12 0.80 0.33 O 28.35% 0 25.28% none of the

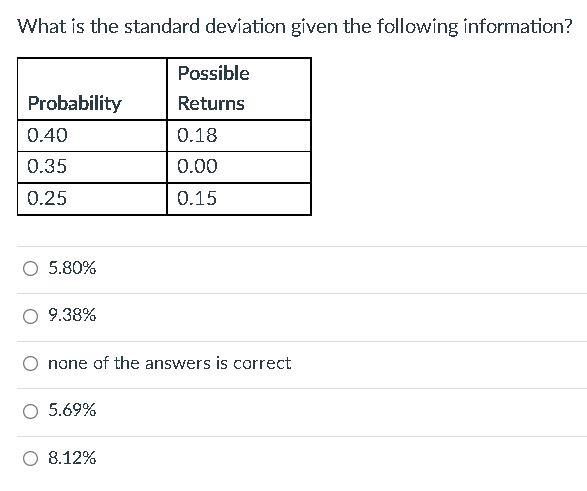

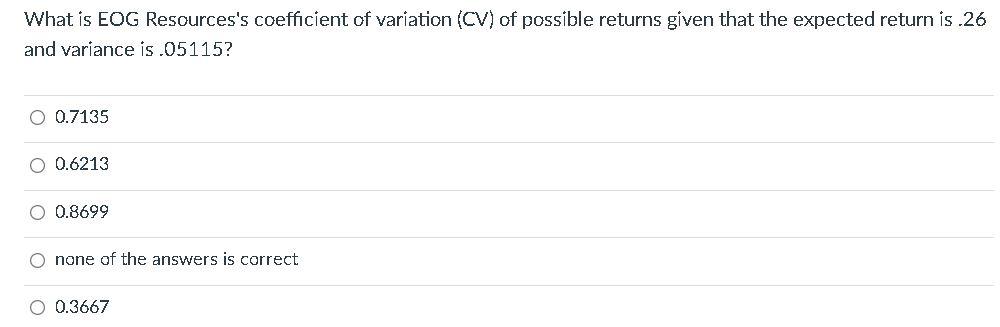

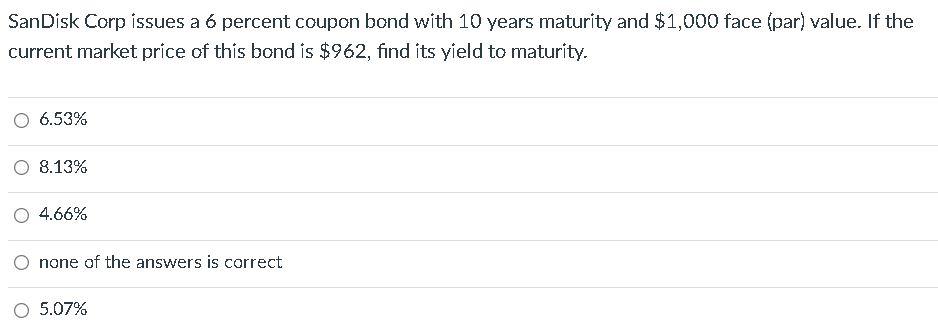

What is the expected return given the following information? Possible Probability Returns 0.05 0.03 0.15 0.12 0.80 0.33 O 28.35% 0 25.28% none of the answers is correct O 13.64% O 20.25% What is the standard deviation given the following information? Possible Probability Returns 0.40 0.18 0.35 0.00 0.25 0.15 O 5.80% 9.38% none of the answers is correct 0 5.69% 8.12% What is EOG Resources's coefficient of variation (CV) of possible returns given that the expected return is.26 and variance is .05115? O 0.7135 O 0.6213 O 0.8699 O none of the answers is correct O 0.3667 SanDisk Corp issues a 6 percent coupon bond with 10 years maturity and $1,000 face (par) value. If the current market price of this bond is $962, find its yield to maturity. 6.53% O 8.13% O 4.66% none of the answers is correct 5.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts