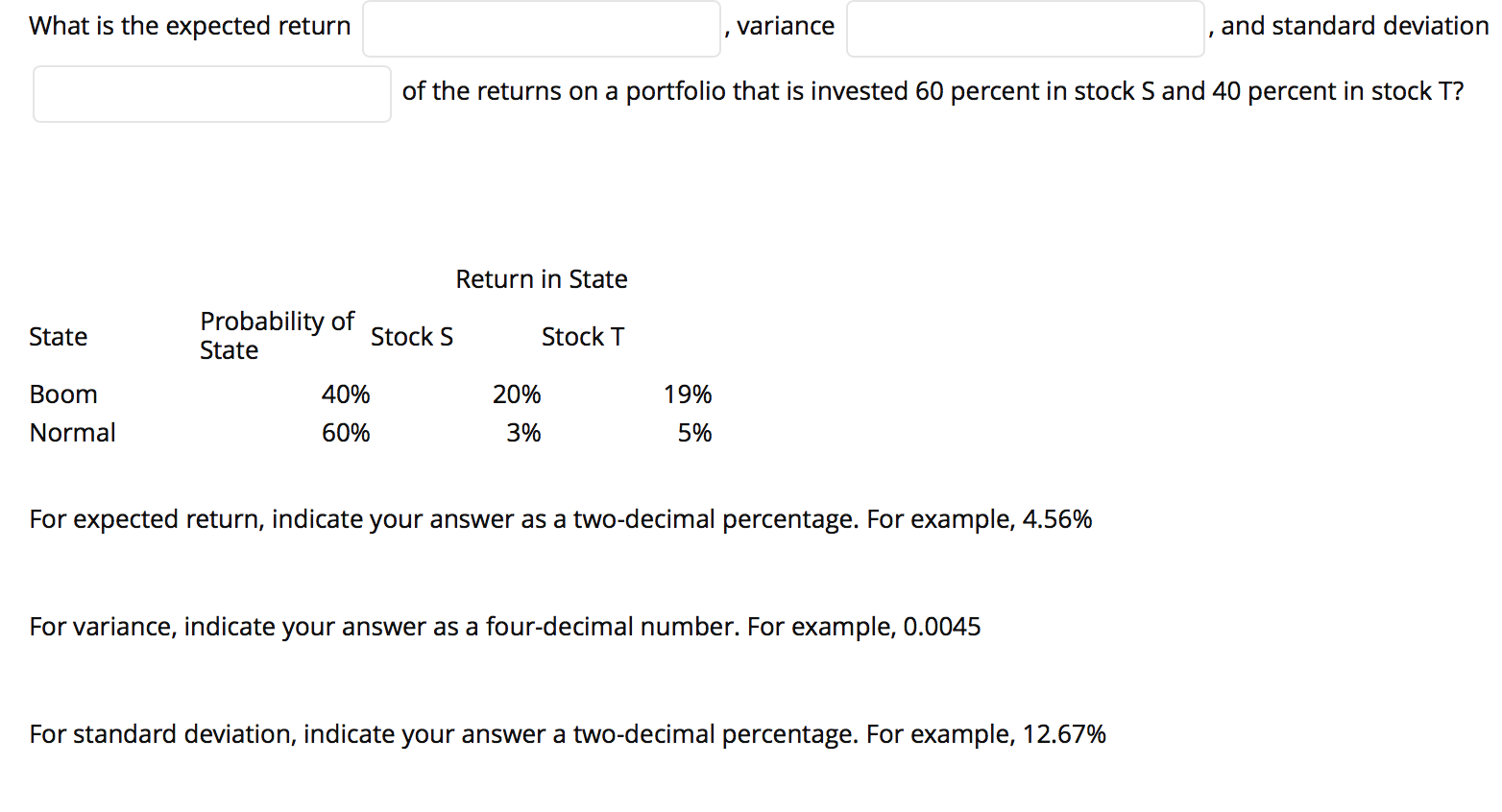

Question: What is the expected return variance and standard deviation of the returns on a portfolio that is invested 60 percent in stock S and 40

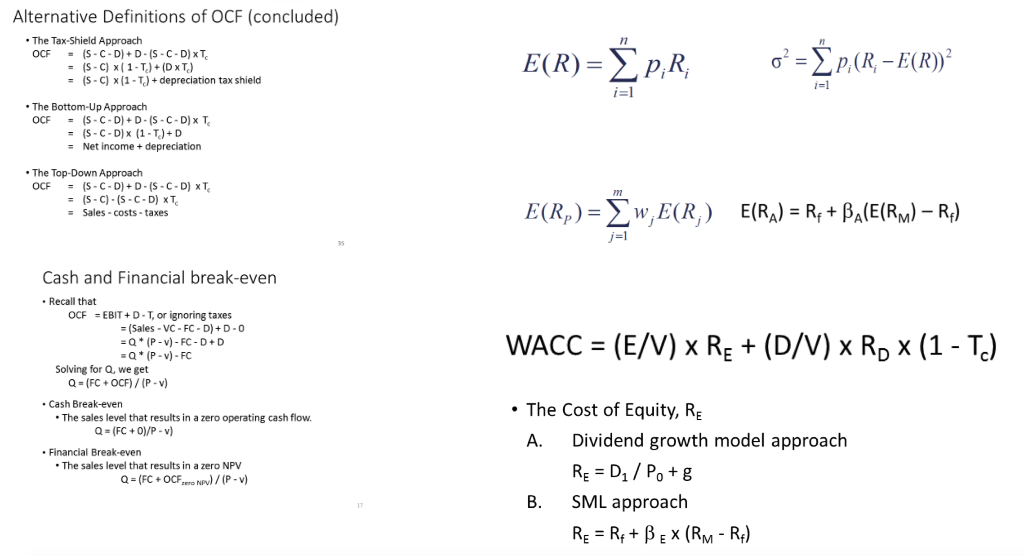

What is the expected return variance and standard deviation of the returns on a portfolio that is invested 60 percent in stock S and 40 percent in stock T? Return in State State Probability of State Stocks Stock T Boom 40% 20% 19% Normal 60% 3% 5% For expected return, indicate your answer as a two-decimal percentage. For example, 4.56% For variance, indicate your answer as a four-decimal number. For example, 0.0045 For standard deviation, indicate your answer a two-decimal percentage. For example, 12.67% Alternative Definitions of OCF (concluded) The Tax-Shield Approach OCF - (S-C-D)+D-S-C-D) TC = (5.C) X( 1-T)+ (DxT) = (5-C) x (1 - T) + depreciation tax shield E(R)= p;R; , o'=P: (R. E(R))? i=1 The Bottom-Up Approach OCF (5-C-D)+D-1S-C-D) X T. = (5-C-D) (1 -T.)+D = Net income + depreciation The Top-Down Approach OCF = (S-C-D)+D-(S-C-D) XT = (5 - C)(S-C-D) XT = Sales - costs - taxes 777 E(R,) = {w,E(R) E(RA) = Rp + Ba(E(Rm) R:) j=1 Cash and Financial break-even Recall that OCF = EBIT +D-T, or ignoring taxes = (Sales - VC-FC-D)+D-O = Q (P-V) - FC-D+D =Q (P-V) - FC Solving for Q, we get QE (FC + OCF)/(P-v) WACC = (E/V) x R + (D/V) x Ro x (1 - Tc) Cash Break-even The sales level that results in a zero operating cash flow. Q = (FC+0)/PV) . Financial Break-even . The sales level that results in a zero NPV Q = (FC + OCF Npv)/(P-v) The Cost of Equity, Re A. Dividend growth model approach R = D / Po+g B. SML approach R = Rp + BEX (RM -RF)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts