Question: what is the full and correct Answer to this question disregard everything I have filled in. I'm not sure if it's right. At December 31,

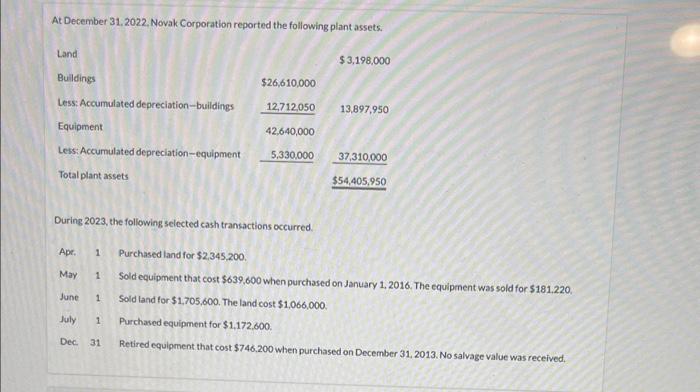

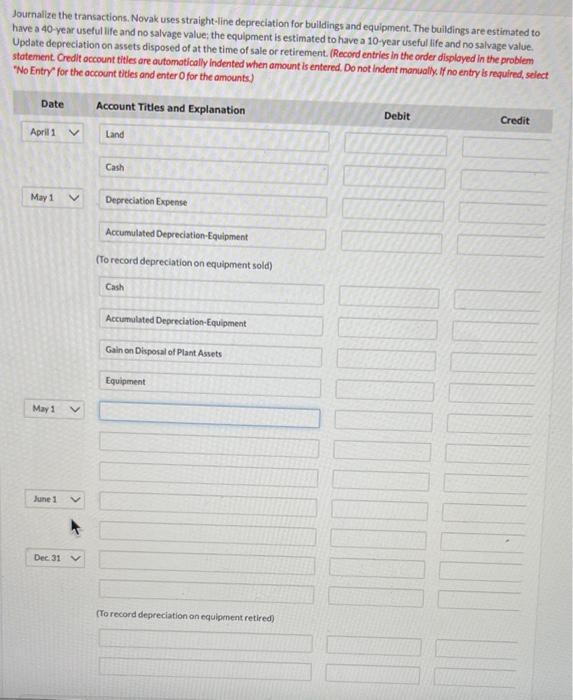

At December 31, 2022. Novak Corporation reported the following plant assets. During 2023, the following selected cash transactions occurred. Ape, 1 Purchased land for $2,345,200 May 1 Sold equipment that cost $639,600 when purchased on January 1,2016. The equipment was sold for $181,220. June 1 Sold land for $1,705,600. The land cost $1,066,000 July 1 Purchased equipment for $1,172,600. Dec. 31 Retired equipment that cost $746,200 when purchased on December 31,2013 . No salvage value was received, Journalize the transactions. Novak uses straight-line depreciation for bulldings and equipment. The buildings are estimated to have a 40 -year useful life and no salvage value; the equipment is estimated to have a 10 -year useful life and no salvage value. Update depreciation on assets disposed of at the time of sale or retirement. (Recond entries in the order displayed in the problem statement. Credlt occount titles are automotically indented when amount is entered. Do not indent manualik. If no entry is required, select "No Entry" for the occount tities and enter Ofor the amounts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts