Question: What is the full answer to this problem? The following information for Blossom Products is available on June 30,2014 , the end of a monthly

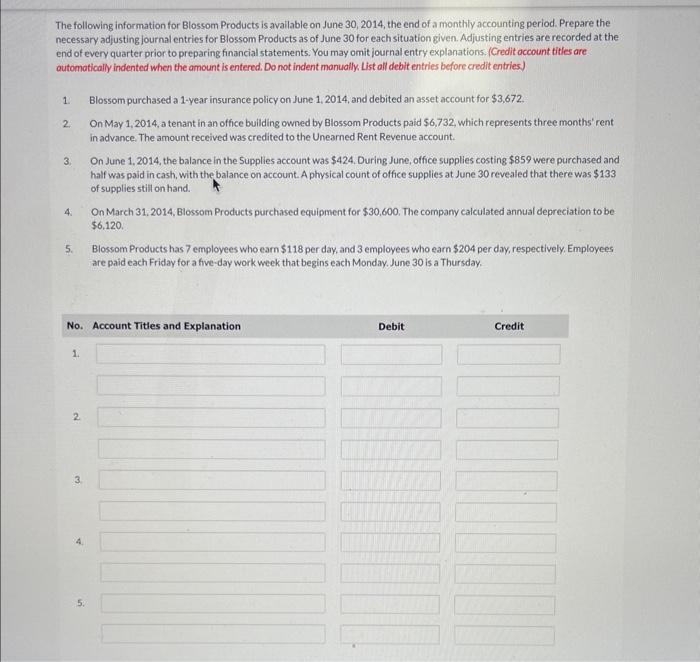

The following information for Blossom Products is available on June 30,2014 , the end of a monthly accounting period. Prepare the necessary adjusting journal entries for Blossom Products as of June 30 for each situation given. Adjusting entries are recorded at the end of every quarter prior to preparing financial statements. You may omit journal entry explanations. (Credit occount titles are outomatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries) 1. Blossom purchased a 1-year insurance policy on June 1, 2014, and debited an asset account for $3,672. 2. On May 1, 2014, a tenant in an office building owned by Blossom Products paid $6,732, which represents three months' rent in advance. The amount received was credited to the Unearned Rent Revenue account. 3. On June 1, 2014, the balance in the Supplies account was $424. During June, office supplies costing $859 were purchased and half was paid in cash, with the balance on account. A physical count of office supplies at June 30 revealed that there was $133 of supplies still on hand. 4. On March 31, 2014, Blossom Products purchased equipment for $30,600. The company calculated annual depreciation to be $6,120. 5. Blossom Products has 7 employees who eam $118 per day, and 3 employees who earn $204 per day, respectively, Employees are paid each Friday for a five-day work week that begins each Monday. June 30 is a Thursday

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts