Question: What is the initial (time zero) cash flow associated with the project? Include all incremental cash flows. What is the annual operating cash flow (OCF)

- What is the initial (time zero) cash flow associated with the project? Include all incremental cash flows.

- What is the annual operating cash flow (OCF) for each year of the Corzine project? Compute only annual OCF.

- Set up a table which details all the incremental cash flows (OCF, net capital spending, net working capital, clean-up costs, etc.) to the Corzine project for each years of 0 through 5. add up the cash flows for each year to get a timeline of the total cash flows to the project at each date on the timeline.

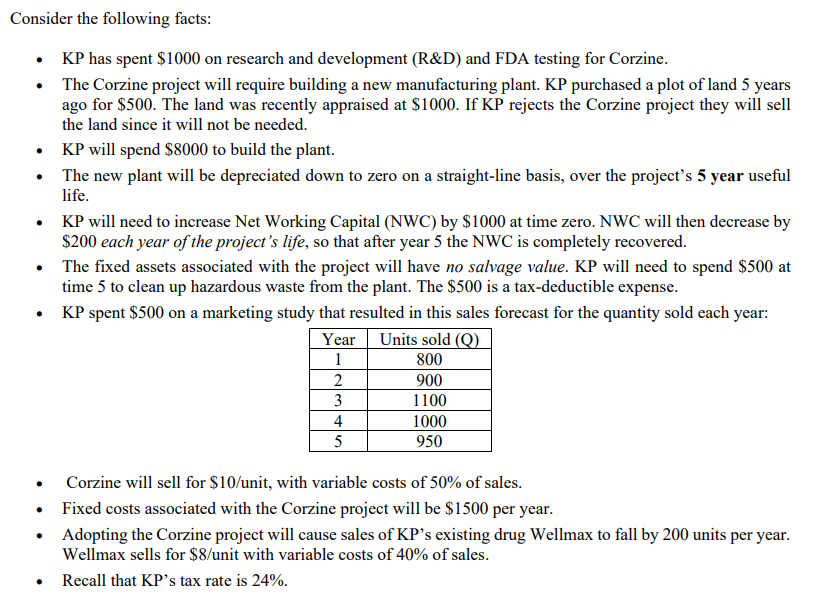

Consider the following facts: KP has spent $1000 on research and development (R&D) and FDA testing for Corzine. The Corzine project will require building a new manufacturing plant. KP purchased a plot of land 5 years ago for $500. The land was recently appraised at $1000. If KP rejects the Corzine project they will sell the land since it will not be needed. KP will spend $8000 to build the plant. The new plant will be depreciated down to zero on a straight-line basis, over the project's 5 year useful life. KP will need to increase Net Working Capital (NWC) by $1000 at time zero. NWC will then decrease by $200 each year of the project's life, so that after year 5 the NWC is completely recovered. The fixed assets associated with the project will have no salvage value. KP will need to spend $500 at time 5 to clean up hazardous waste from the plant. The $500 is a tax-deductible expense. KP spent $500 on a marketing study that resulted in this sales forecast for the quantity sold each year: | Year Units sold (Q) 800 900 1100 1000 950 Corzine will sell for $10/unit, with variable costs of 50% of sales. Fixed costs associated with the Corzine project will be $1500 per year. Adopting the Corzine project will cause sales of KP's existing drug Wellmax to fall by 200 units per year. Wellmax sells for $8/unit with variable costs of 40% of sales. Recall that KP's tax rate is 24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts