Question: What is the interest rate or the rate of return in each case? 1. Deposited $2,000 at a bank and received $5 in interest

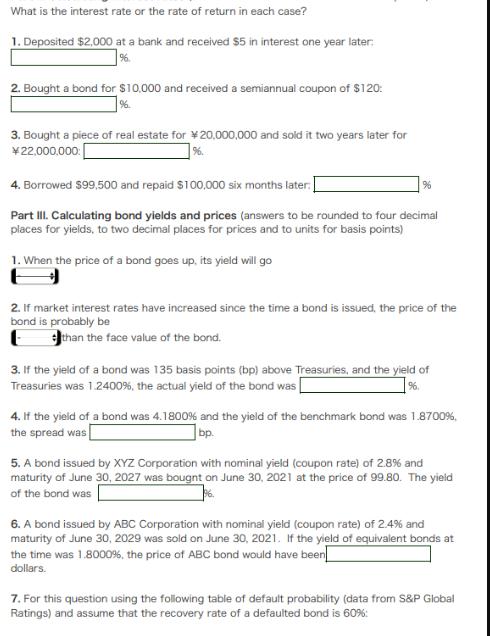

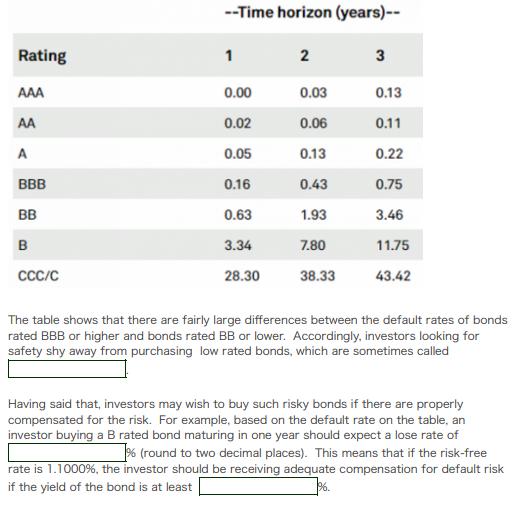

What is the interest rate or the rate of return in each case? 1. Deposited $2,000 at a bank and received $5 in interest one year later. 2. Bought a bond for $10,000 and received a semiannual coupon of $120: 3. Bought a piece of real estate for 20,000,000 and sold it two years later for 22,000,000[ 4. Borrowed $99,500 and repaid $100,000 six months later: [ Part III. Calculating bond yields and prices (answers to be rounded to four decimal places for yields, to two decimal places for prices and to units for basis points) 1. When the price of a bond goes up, its yield will go % 2. If market interest rates have increased since the time a bond is issued, the price of the bond is probably be than the face value of the bond. 3. If the yield of a bond was 135 basis points (bp) above Treasuries, and the yield of Treasuries was 1.2400%, the actual yield of the bond was %6. 4. If the yield of a bond was 4.1800% and the yield of the benchmark bond was 1.8700%, the spread was bp. 5. A bond issued by XYZ Corporation with nominal yield (coupon rate) of 2.8% and maturity of June 30, 2027 was bougnt on June 30, 2021 at the price of 99.80. The yield of the bond was 6. A bond issued by ABC Corporation with nominal yield (coupon rate) of 2.4% and maturity of June 30, 2029 was sold on June 30, 2021. If the yield of equivalent bonds at the time was 1.8000%, the price of ABC bond would have been dollars. 7. For this question using the following table of default probability (data from S&P Global Ratings) and assume that the recovery rate of a defaulted bond is 60%: Rating AAA AA A BBB BB B CCC/C --Time horizon (years)-- 1 0.00 0.02 0.05 0.16 0.63 3.34 28.30 2 0.03 0.06 0.13 0.43 1.93 7.80 38.33 3 0.13 0.11 0.22 0.75 3.46 11.75 43.42 The table shows that there are fairly large differences between the default rates of bonds rated BBB or higher and bonds rated BB or lower. Accordingly, investors looking for safety shy away from purchasing low rated bonds, which are sometimes called Having said that, investors may wish to buy such risky bonds if there are properly compensated for the risk. For example, based on the default rate on the table, an investor buying a B rated bond maturing in one year should expect a lose rate of % (round to two decimal places). This means that if the risk-free rate is 1.1000%, the investor should be receiving adequate compensation for default risk if the yield of the bond is at least

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

To calculate the adequate compensation for default risk we need to determine the ... View full answer

Get step-by-step solutions from verified subject matter experts