Question: what is the IRAC solution to these problems? 3. For 10 years, a certified public accounting firm aud- ited the books of an investment company

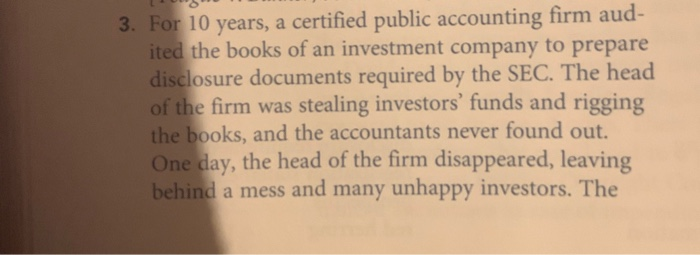

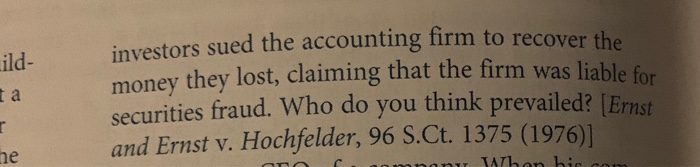

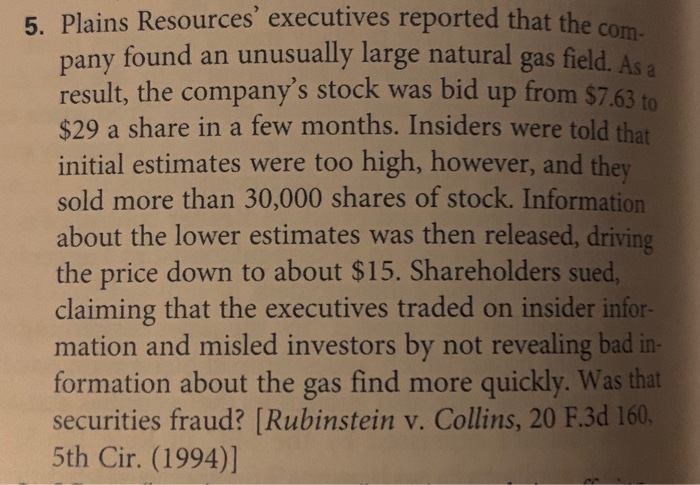

3. For 10 years, a certified public accounting firm aud- ited the books of an investment company to prepare disclosure documents required by the SEC. The head of the firm was stealing investors' funds and rigging the books, and the accountants never found out. One day, the head of the firm disappeared, leaving behind a mess and many unhappy investors. The ild- ta investors sued the accounting firm to recover the money they lost, claiming that the firm was liable for securities fraud. Who do you think prevailed? [Ernst! and Ernst v. Hochfelder, 96 S.Ct. 1375 (1976) omon Yhon bicce 5. Plains Resources' executives reported that the com pany found an unusually large natural gas field result, the company's stock was bid up from $7.63 $29 a share in a few months. Insiders were told that initial estimates were too high, however, and they sold more than 30,000 shares of stock. Information about the lower estimates was then released, driving the price down to about $15. Shareholders sued, claiming that the executives traded on insider infor mation and misled investors by not revealing bad in formation about the gas find more quickly. Was that securities fraud? [Rubinstein v. Collins, 20 F.3d 160, 5th Cir. (1994) 3. For 10 years, a certified public accounting firm aud- ited the books of an investment company to prepare disclosure documents required by the SEC. The head of the firm was stealing investors' funds and rigging the books, and the accountants never found out. One day, the head of the firm disappeared, leaving behind a mess and many unhappy investors. The ild- ta investors sued the accounting firm to recover the money they lost, claiming that the firm was liable for securities fraud. Who do you think prevailed? [Ernst! and Ernst v. Hochfelder, 96 S.Ct. 1375 (1976) omon Yhon bicce 5. Plains Resources' executives reported that the com pany found an unusually large natural gas field result, the company's stock was bid up from $7.63 $29 a share in a few months. Insiders were told that initial estimates were too high, however, and they sold more than 30,000 shares of stock. Information about the lower estimates was then released, driving the price down to about $15. Shareholders sued, claiming that the executives traded on insider infor mation and misled investors by not revealing bad in formation about the gas find more quickly. Was that securities fraud? [Rubinstein v. Collins, 20 F.3d 160, 5th Cir. (1994)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts