Question: What is the key difference between forward and future contracts? Assume that your firm purchased and received some goods from Italy and has agreed

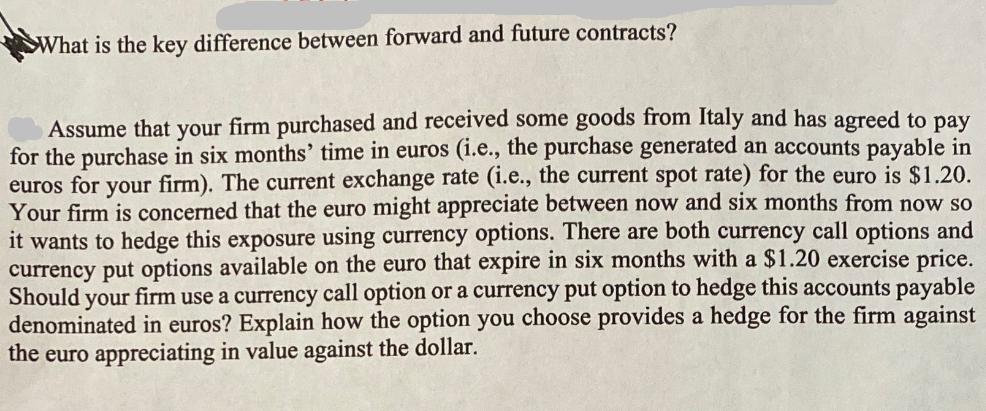

What is the key difference between forward and future contracts? Assume that your firm purchased and received some goods from Italy and has agreed to pay for the purchase in six months' time in euros (i.e., the purchase generated an accounts payable in euros for your firm). The current exchange rate (i.e., the current spot rate) for the euro is $1.20. Your firm is concerned that the euro might appreciate between now and six months from now so it wants to hedge this exposure using currency options. There are both currency call options and currency put options available on the euro that expire in six months with a $1.20 exercise price. Should your firm use a currency call option or a currency put option to hedge this accounts payable denominated in euros? Explain how the option you choose provides a hedge for the firm against the euro appreciating in value against the dollar.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

The key difference between forward and future contracts is that forward contracts are privately nego... View full answer

Get step-by-step solutions from verified subject matter experts