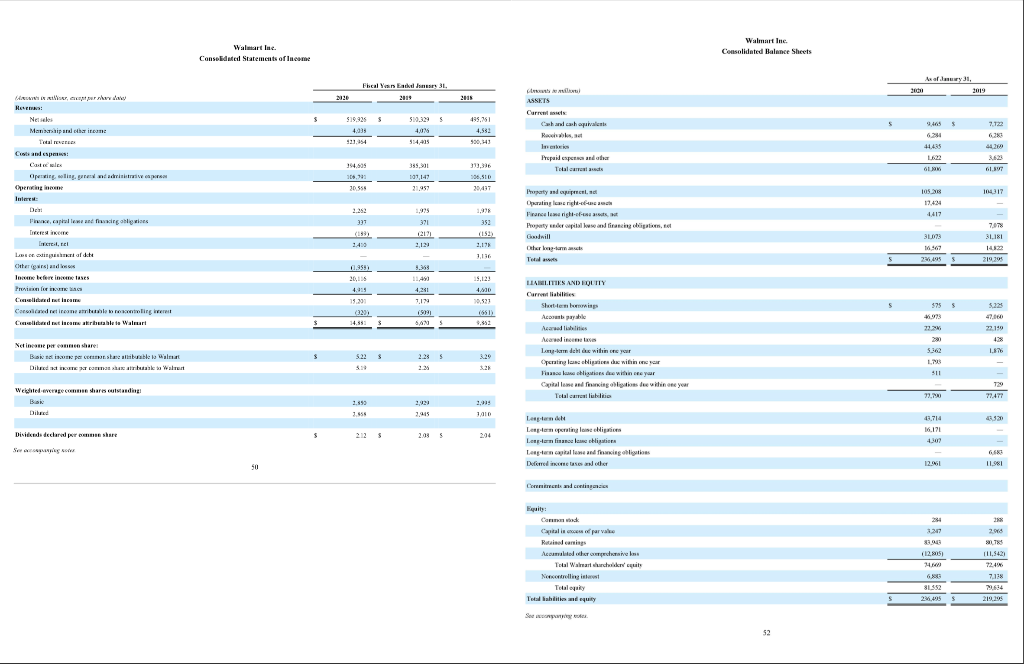

Question: What is the main expense or cost causing Walmart's Operating Income Margin to be what it is (use Income Statement)? Consecuted Statements of la Fheal

What is the main expense or cost causing Walmart's Operating Income Margin to be what it is (use Income Statement)?

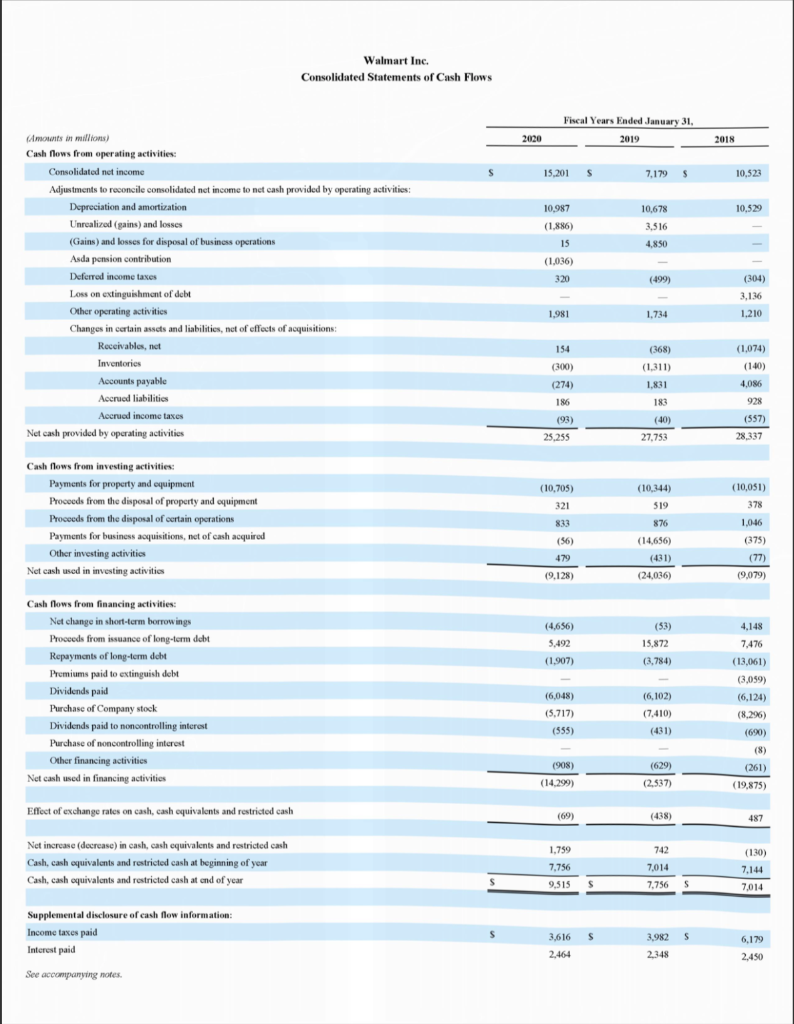

Consecuted Statements of la Fheal Yan Etikel muss 31. Diada declara perche Walmart Inc. Consolidated Statements of Cash Flows Fiscal Years Ended January 31, , 2019 2020 2018 S 15.201 S s 7,179 $ 10.521 10,678 10,529 10,987 (1.886) 3,516 4,850 15 (1,036) 320 (499) (Amounts in millions Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses (Gains) and losses for disposal of business operations Asda pension contribution Deferred income taxes Loss on extinguishment of debt Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities (304) 3,136 1,981 1.734 1.210 154 (368) (1.311) (1,074) (140) (300) 1,831 (274) 186 4,086 928 183 (93) 25.255 (40) 27,753 (557) 28,337 (10,344) (10,705) 321 Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (10,051) 378 1.046 833 519 876 (14,656) (431) (56) (375) 479 (77) (9.128) (24,036) (9,079) (4,656) ( 5.492 (53) 15.872 (1,907) (3,784) Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term deht Repayments of long-term dicht Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities 4,148 7.476 (13,061) (3,059) (6,124) (6.048) (6,102) (7.410) (431) (5.717) (555) (8,2%6) (690) (8) (629) (908) (14.299) (261) (19,875) (2.537) Effect of exchange rates on cash, cash equivalents and restricted cash (69) (438) 487 1,759 Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of year 742 7,014 7.756 9,515 (130) 7.144 7,014 7,756 S S s S s 6,179 Supplemental disclosure of cash flow information: Income taxes paid Interest paid See accompanying notes 3,616 2464 3.982 2,348 2.450 Consecuted Statements of la Fheal Yan Etikel muss 31. Diada declara perche Walmart Inc. Consolidated Statements of Cash Flows Fiscal Years Ended January 31, , 2019 2020 2018 S 15.201 S s 7,179 $ 10.521 10,678 10,529 10,987 (1.886) 3,516 4,850 15 (1,036) 320 (499) (Amounts in millions Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses (Gains) and losses for disposal of business operations Asda pension contribution Deferred income taxes Loss on extinguishment of debt Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities (304) 3,136 1,981 1.734 1.210 154 (368) (1.311) (1,074) (140) (300) 1,831 (274) 186 4,086 928 183 (93) 25.255 (40) 27,753 (557) 28,337 (10,344) (10,705) 321 Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (10,051) 378 1.046 833 519 876 (14,656) (431) (56) (375) 479 (77) (9.128) (24,036) (9,079) (4,656) ( 5.492 (53) 15.872 (1,907) (3,784) Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term deht Repayments of long-term dicht Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities 4,148 7.476 (13,061) (3,059) (6,124) (6.048) (6,102) (7.410) (431) (5.717) (555) (8,2%6) (690) (8) (629) (908) (14.299) (261) (19,875) (2.537) Effect of exchange rates on cash, cash equivalents and restricted cash (69) (438) 487 1,759 Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of year 742 7,014 7.756 9,515 (130) 7.144 7,014 7,756 S S s S s 6,179 Supplemental disclosure of cash flow information: Income taxes paid Interest paid See accompanying notes 3,616 2464 3.982 2,348 2.450

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts