Question: what is the mathmatical process to getting the answer at the bottom? like how do i actually solve for all 40 periods? excel? financial calculator?

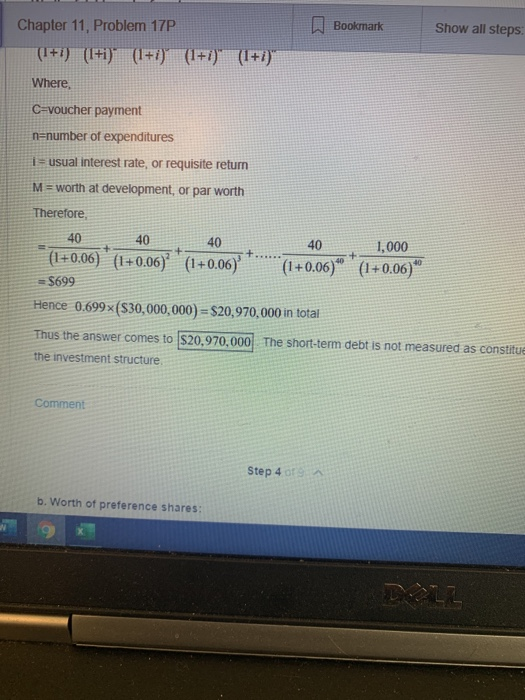

Bookmark Show all steps Chapter 11, Problem 17P (1+1 (1+i)(1+i)(1+i)(1+)" Where. C=voucher payment n=number of expenditures i = usual interest rate, or requisite return M = worth at development, or par worth Therefore 40 40 40 (1+0.06) (1+0.06) (1+0.06) = $699 + + 40 1,000 (1+0.06)*(1+0.06)" + Hence 0.699 (S30,000,000) = $20,970,000 in total Thus the answer comes to $20,970,000 The short-term debt is not measured as constitue the investment structure Comment Step 4 of 9 b. Worth of preference shares: TOLE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts