Question: What is the maximum amount that we can bid for an offshore lease if we have a 30% investment opportunity rate (and assume we

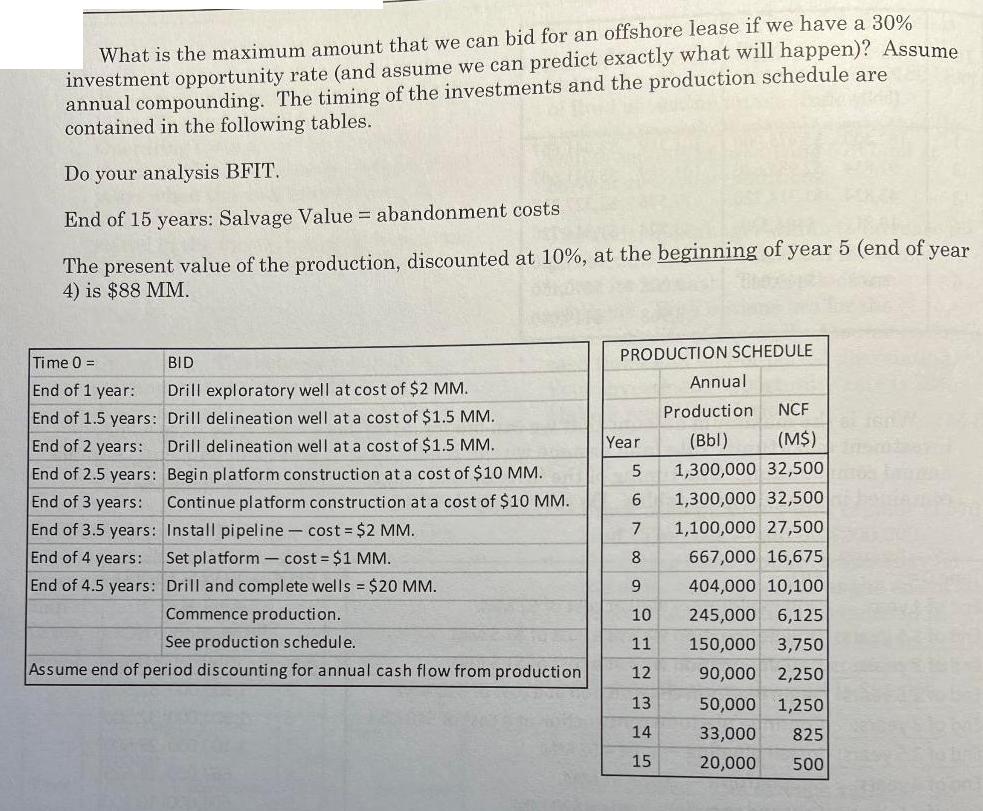

What is the maximum amount that we can bid for an offshore lease if we have a 30% investment opportunity rate (and assume we can predict exactly what will happen)? Assume annual compounding. The timing of the investments and the production schedule are contained in the following tables. Do your analysis BFIT. End of 15 years: Salvage Value = abandonment costs The present value of the production, discounted at 10%, at the beginning of year 5 (end of year 4) is $88 MM. Time 0 = End of 1 year: End of 1.5 years: End of 2 years: End of 2.5 years: End of 3 years: End of 3.5 years: End of 4 years: End of 4.5 years: BID Drill exploratory well at cost of $2 MM. Drill delineation well at a cost of $1.5 MM. Drill delineation well at a cost of $1.5 MM. Begin platform construction at a cost of $10 MM. Continue platform construction at a cost of $10 MM. Install pipeline - cost = $2 MM. Set platform cost = $1 MM. Drill and complete wells = $20 MM. Commence production. See production schedule. Assume end of period discounting for annual cash flow from production PRODUCTION SCHEDULE Year 5 6 7 8 9 10 11 12 13 14 15 Annual Production NCF (Bbl) (M$) 1,300,000 32,500 1,300,000 32,500 1,100,000 27,500 667,000 16,675 404,000 10,100 6,125 245,000 150,000 3,750 90,000 2,250 50,000 1,250 33,000 825 20,000 500 br

Step by Step Solution

There are 3 Steps involved in it

To determine the maximum amount that can be bid for an offshore lease with a 30 investment opportuni... View full answer

Get step-by-step solutions from verified subject matter experts