Question: What is the maximum correlation that still allows for diversification (i.e. reduction of the portfolio variance below the variance of either asset) without short sales?

What is the maximum correlation that still allows for diversification (i.e. reduction of the portfolio variance below the variance of either asset) without short sales?

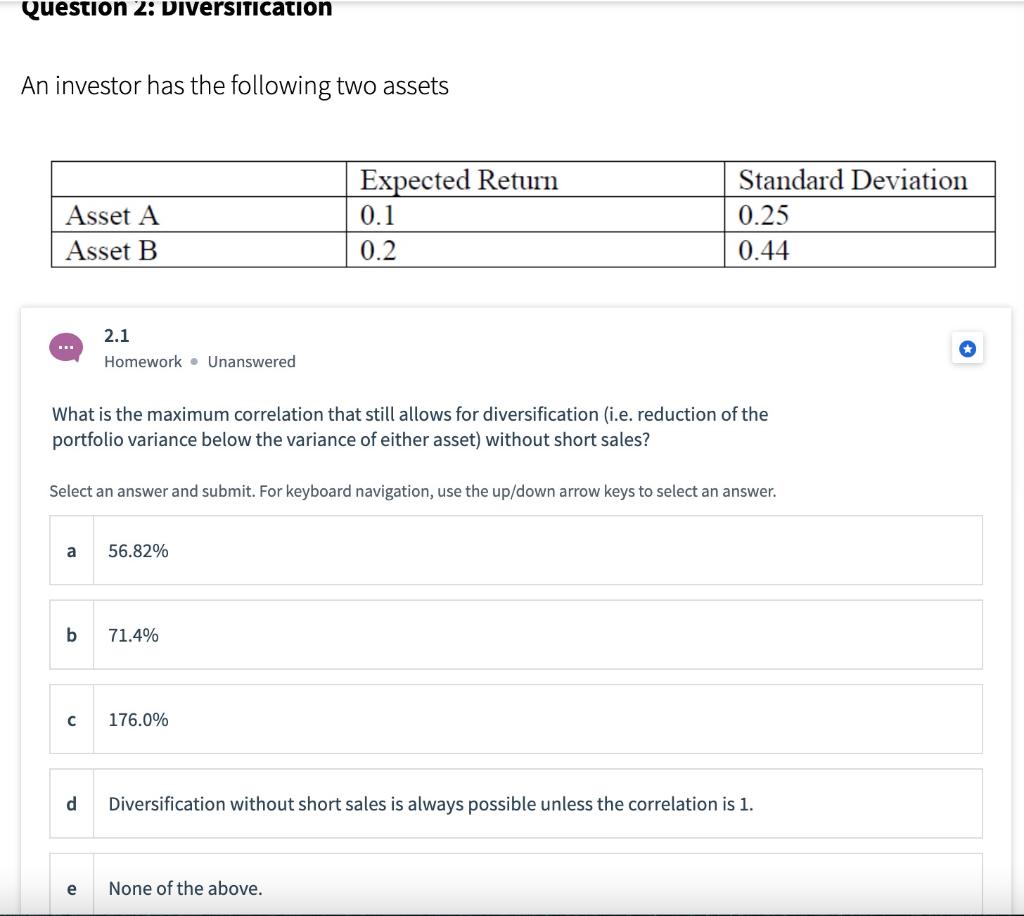

Question 2: Diversification An investor has the following two assets Asset A Asset B Expected Return 0.1 0.2 Standard Deviation 0.25 0.44 2.1 Homework. Unanswered What is the maximum correlation that still allows for diversification (i.e. reduction of the portfolio variance below the variance of either asset) without short sales? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 56.82% b 71.4% 176.0% d Diversification without short sales is always possible unless the correlation is 1. e None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts