Question: What is the missing function to get this output?(it will use paython selection statements to calculate amount of tax that a single (unmarried) taxpayer owes

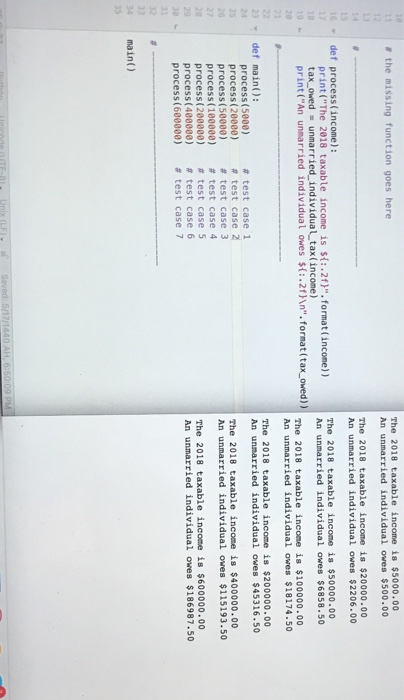

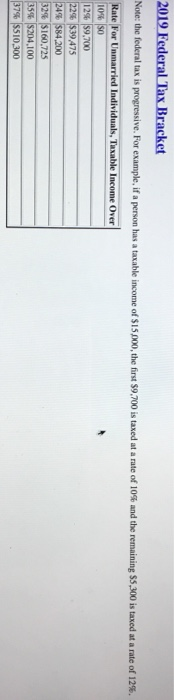

10 The 2018 taxable income is $5000.00 An unmarried individual owes $500.00 # the missing function goes here The 2018 taxable income is $20000.00 An unmarried individual owes $2206.00 def process(income): printTe 2na rried individua L tax( income) tax owed unmarried_ individuatax(income) print ("An unmarried individual owes $2tNn".fornat (tax-owed)) The 2018 taxable income is $50000.00 An unmarried individual owes $6858.50 2018 taxable income is st:.2f)".format (income)) format(tax_owed)) The 2018 taxable income is s: The 2018 taxable income is $100000.00 An unmarried individual owes $18174.50 23 | def main(): The 2018 taxable income is $200000.00 An unmarried individual owes $45316.50 process (5000) process(20000) process(50000) process( 100000) process (200000) process(400000) process(600000) # test case 1 # test case 2 # test case 3 # test case 4 # test case 5 # test case 6 # test case 7 The 2018 taxable income is $400000.00 An unmarried individual owes $115193.50 The 2018 taxable income is $600000.00 An unmarried individual owes $186987.50 34 main() 2019 Federal Tax Bracket Note he federal tais progressive. For example, if a person has taxable in ome of $15,000, the first $9.700 is taxed at a rate of 10% and the remaining SS 300 is taxed at a rate of 12% 10% 9,475

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts