Question: What is the money market? Give two examples. Why do we need the money market? What is the difference in basis points between the discount

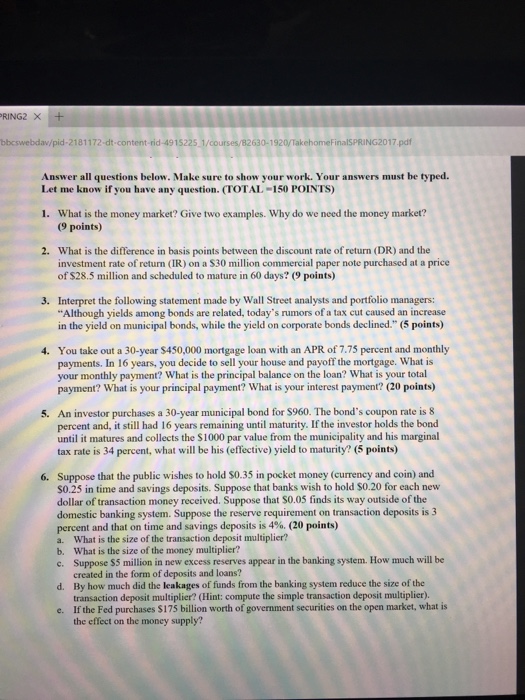

What is the money market? Give two examples. Why do we need the money market? What is the difference in basis points between the discount rate of return (DR) and the investment rate of return (IR) on a $30 million commercial paper note purchased at a price of $28.5 million and scheduled to mature in 60 days? Interpret the following statement made by Wall Street analysts and portfolio managers: "Although yields among bonds are related, today's rumors of a tax cut caused an increase in the yield on municipal bonds, while the yield on corporate bonds declined." You take out a 30-year $450,000 mortgage loan with an APR of 7.75 percent and monthly payments. In 16 years you decide to sell your house and payoff the mortgage. What is your monthly payment? What is the principal balance on the loan? What is your total payment? What is your principal payment? What is your interest payment? An investor purchases a 30-year municipal bond for $960. The bond's coupon rate is 8 percent and. it still had 16 years remaining until maturity. If the investor holds the bond until it matures and collects the $1000 par value from the municipality and his marginal tax rate is 34 percent, what will be his (effective) yield to maturity? Suppose that the public wishes to hold $0.35 in pocket money (currency and coin) and $0.25 in time and savings deposits. Suppose that banks wish to hold $0.20 for each new dollar of transaction money received. Suppose that $0.05 finds its way outside of the domestic banking system. Suppose the reserve requirement on transaction deposits is 3 percent and that on time and savings deposits is 4 %. a. What is the size of the transaction deposit multiplier? b. What is the size of the money multiplier? c. Suppose S5 million in new excess reserves appear in the banking system. How much will be created in the form of deposits and loans? d. By how much did the leakages of funds from the banking system reduce the size of the transaction deposit multiplier? e. If the Fed purchases $175 billion worth of government securities on the open market, what is the effect on the money supply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts