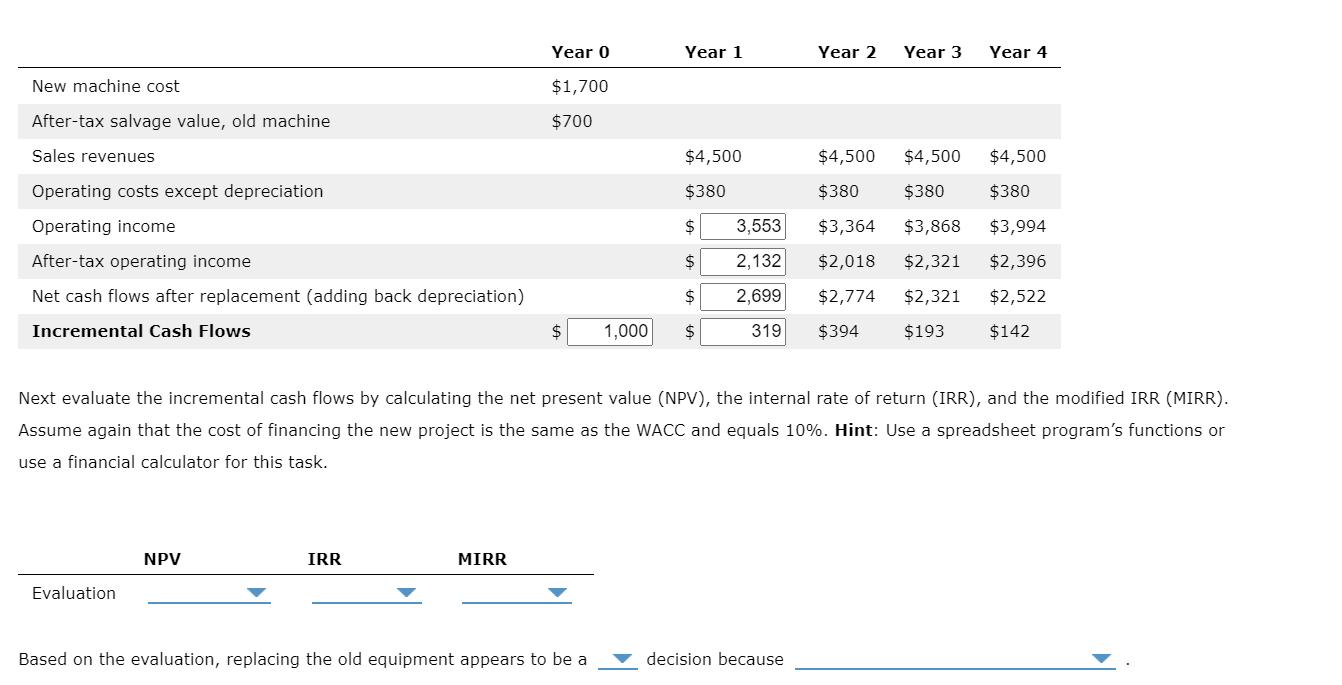

Question: What is the net present value (NPV), the internal rate of return (IRR), and the modified IRR (MIRR)? 2. Based on the evaluation, replacing the

What is the net present value (NPV), the internal rate of return (IRR), and the modified IRR (MIRR)?

2. Based on the evaluation, replacing the old equipment appears to be a (good or bad) decision because ( The IRR is small, or the MIRR is lower than the IRR, or the NPV is negative)

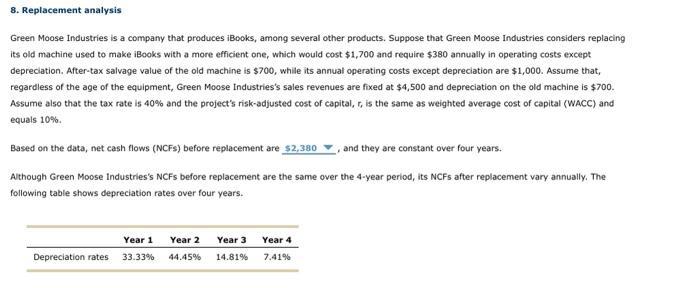

New machine cost After-tax salvage value, old machine Sales revenues Operating costs except depreciation Operating income After-tax operating income Net cash flows after replacement (adding back depreciation) Incremental Cash Flows Evaluation NPV IRR Year 0 $1,700 $700 MIRR Year 1 Based on the evaluation, replacing the old equipment appears to be a $4,500 $380 $ $ $ 1,000 $ Year 2 Year 3 Next evaluate the incremental cash flows by calculating the net present value (NPV), the internal rate of return (IRR), and the modified IRR (MIRR). Assume again that the cost of financing the new project is the same as the WACC and equals 10%. Hint: Use a spreadsheet program's functions or use a financial calculator for this task. $4,500 $380 $4,500 $380 3,553 $3,364 2,132 $2,018 $2,321 2,699 $2,774 $2,321 319 $394 $193 decision because Year 4 $4,500 $380 $3,868 $3,994 $2,396 $2,522 $142

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

To evaluate the replacement decision for Green Moose Industries we need to calculate the net present ... View full answer

Get step-by-step solutions from verified subject matter experts