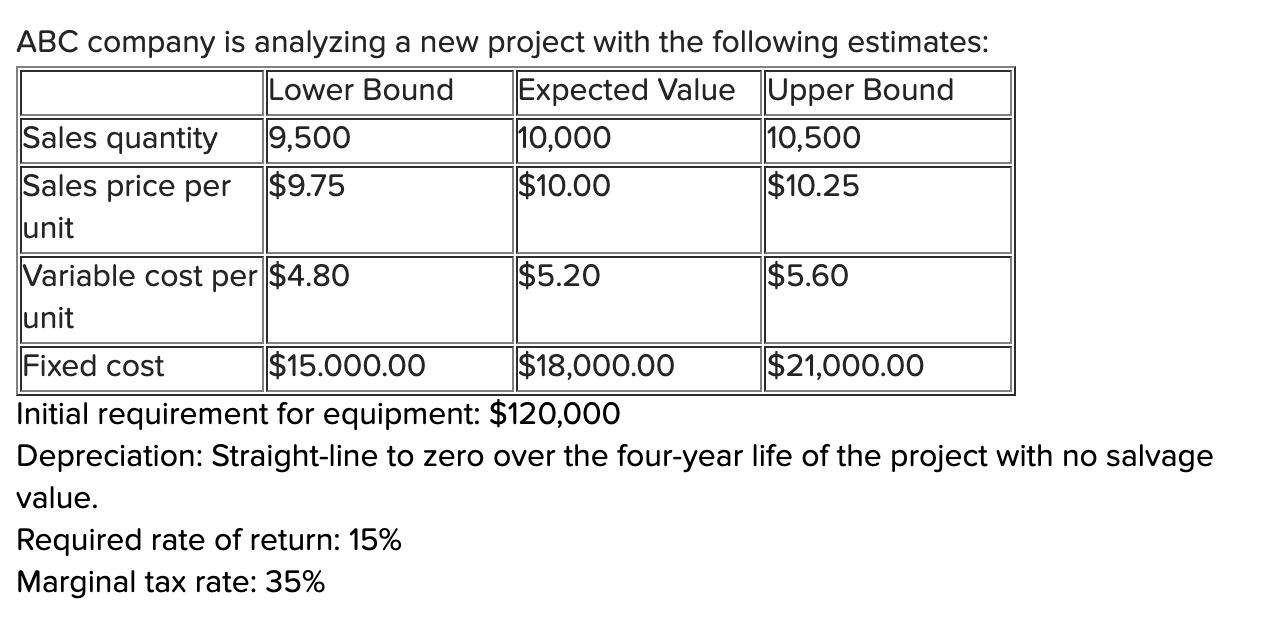

Question: What is the net present value under the worst-case scenario? ABC company is analyzing a new project with the following estimates: Lower Bound Expected Value

What is the net present value under the worst-case scenario?

What is the net present value under the worst-case scenario?

ABC company is analyzing a new project with the following estimates: Lower Bound Expected Value Upper Bound Sales quantity 9,500 ||10,000 10,500 Sales price per $9.75 $10.00 $10.25 unit Variable cost per$4.80 $5.20 $5.60 unit Fixed cost $15.000.00 $18,000.00 $21,000.00 Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value. Required rate of return: 15% Marginal tax rate: 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts