Question: What is the operating cash flow for this project in year 1? $ 340,000 (Round to the nearest dollar.) What is the operating cash flow

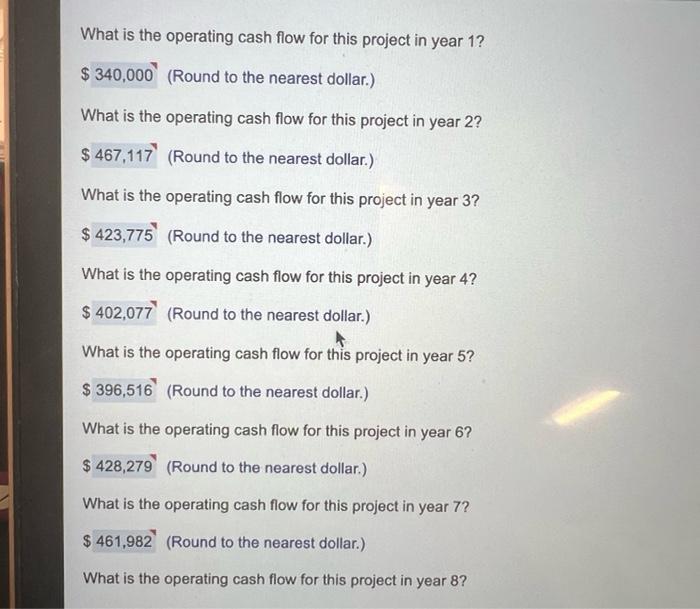

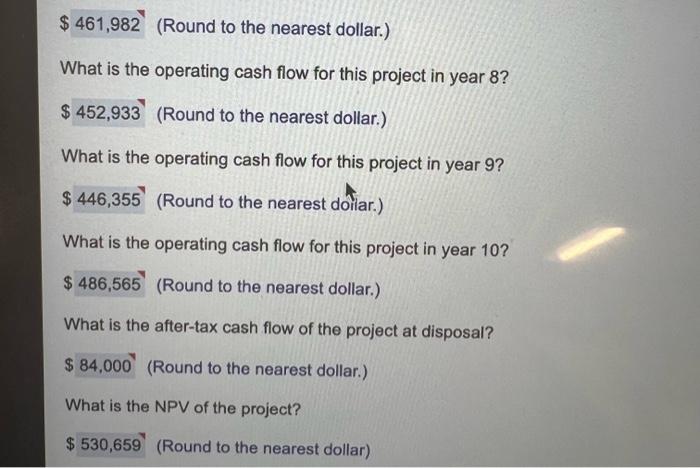

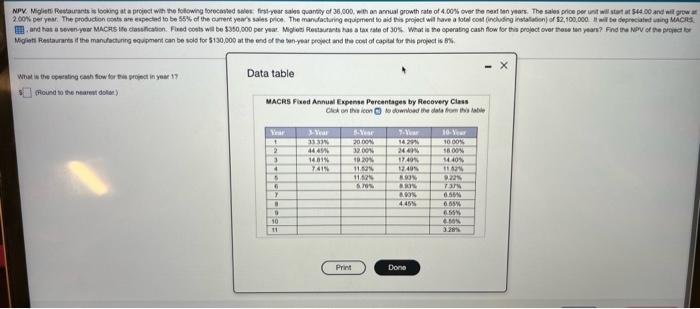

What is the operating cash flow for this project in year 1? $ 340,000 (Round to the nearest dollar.) What is the operating cash flow for this project in year 2? $ 467,117' (Round to the nearest dollar.) What is the operating cash flow for this project in year 3? $ 423,775 (Round to the nearest dollar.) What is the operating cash flow for this project in year 4? $ 402,077' (Round to the nearest dollar.) What is the operating cash flow for this project in year 5? $ 396,516 (Round to the nearest dollar.) What is the operating cash flow for this project in year 6? $ 428,279 (Round to the nearest dollar.) What is the operating cash flow for this project in year 7? $ 461,982 (Round to the nearest dollar.) What is the operating cash flow for this project in year 8? $ 461,982 (Round to the nearest dollar.) What is the operating cash flow for this project in year 8? $ 452,933 (Round to the nearest dollar.) What is the operating cash flow for this project in year 9? $ 446,355 (Round to the nearest dollar.) What is the operating cash flow for this project in year 10? $ 486,565 (Round to the nearest dollar.) What is the after-tax cash flow of the project at disposal? $ 84,000 (Round to the nearest dollar.) What is the NPV of the project? $ 530,659 (Round to the nearest dollar) NPV. Migist Restaurants slooking at a project win the following forecasted on first-year sa quantity of 36,000 with an annual growth rate of 4.00% over the next ten years. The sale priceperunt will start at $4400 and will grow 2.00 per year. The productions are expected to be 55% of the current year's sales prior. The mandacturing equipment to this project will have a falcon including installation of $2,100,000 will be deprecated using MARE and has a sevenyor MACRIS 10 cation Feed costs will be $380,000 per year. Miro Restaurants has a tax rate of 30% What is the operating cash flow for this project over these ten years? Find the NPV of the prot bor Migliott Restaurants if the manufacturing equipment can be solfo 5130,000 at the end of the year project and the cost of capital for this project is Data table What is the court cash flow for this project in year 19 Mound to the predohet MACRS Feed Annual Expense Percentages by Recovery Class Click on the con to download the data from the table + 2 3 4 5 33 44 12815 IN -Year 200 3200 1020 11.00 11/02 18 2440 1740 2405 ON 10 10 DOS SOON 14404 AN 922 ar 0.56 6 ON 4 455 . 10 11 O Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts