Question: What is the operating cash flow for this project in year 1,2,3,4,5,6,7,8,9,10? NPV. Miglietti Restaurants is looking at a project with the following forecasted sales:

What is the operating cash flow for this project in year 1,2,3,4,5,6,7,8,9,10?

What is the operating cash flow for this project in year 1,2,3,4,5,6,7,8,9,10?

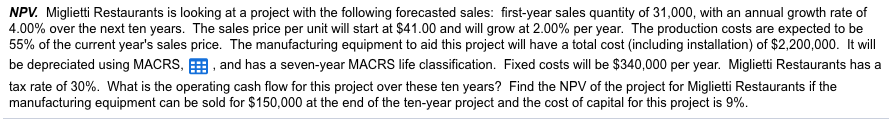

NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 31,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $41.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost includ ng installation of $2.200,000. It will be depreciated using MACRS, EB, and has a seven-year MACRS life classification. Fixed costs will be $340,000 per year. Miglietti Restaurants has a tax rate of 30% What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $150,000 at the end of the ten-year project and the cost of capital for this project is 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts