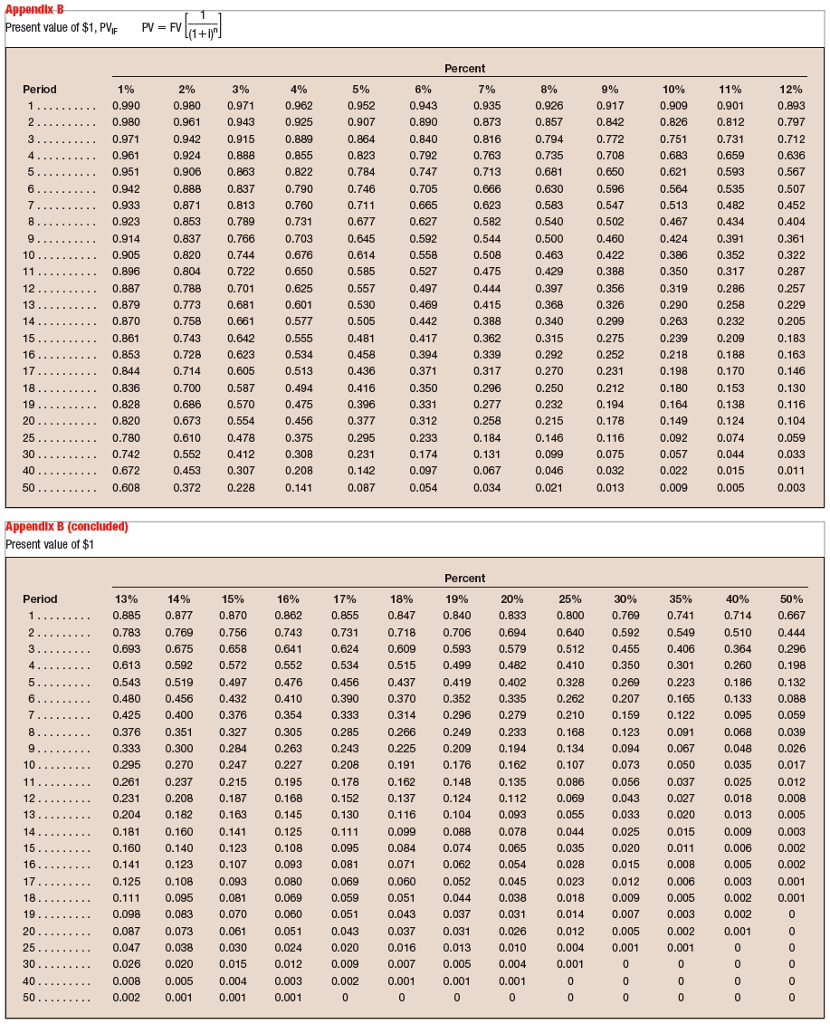

Question: What is the present value of: Use Appendix B as an approximate answer, but calculate your final answer using the formula and financial calculator methods.

| What is the present value of: |

| Use Appendix B as an approximate answer, but calculate your final answer using the formula and financial calculator methods.

|

| a. | $7,600 in 12 years at 5 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) |

| Present value | $ |

| b. | $16,300 in 6 years at 8 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) |

| Present value | $ |

| c. | $25,500 in 18 years at 7 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) |

| Present value | $ |

Appendix B sent value of $1, PVI Period 3% 0.990 0.980 0.971 0.980 0.96 0.943 0.97 0.942 0.915 0.96 0.924. 0.888 0.95 0.906 0.863 0.942 0.888 0.837 0.933 0.87 0.813 0.923 0.853 0.789 0.914 0.837 0.766 10 0.905 0.820 0.744. 0.804 0.722 11 0.896 12 0.887 0.788 0.701 13 0.879 0.773 0.68 0.870 14 0.758 0.66 0.743 0.642 15 0.86 0.853 0.728 0.623 17 0.844. 0.714 0.605 18 0.836 0.700 0.587 190 0.828 0.686 0.570 200 0.820 0.673 0.554 25 0.780 0.610 0.478 30 0.742 0.552 0.412 400 0.672 0.453 0.307 50 0.608 0.372 0.228 Appendix B (concluded) esent value of Period 13% 14% 15% 0.885 0.877 0.870 0.783 0.769 0.756 0.693 0.675 0.658 0.613 0.592 0.572 0.543 0.519 0.497 0.480 0.456 0.432 0.425 0.400 0.376 0.376 0.35 0.327 0.333 0.300 0.284 10 0.295 0.270 0.247 0.261 0.237 0.215 0.231 12 0.208 0.187 13 0.204. 0.182 0.163 14 0.181 0.160 0.141 0.160 0.140 0.123 16 0.141 0.123 0.107 17 0.125 0.108 0.093 18 0.095 0.08 0.098 0.083 0.070 20 0.087 0.073 0.061 25 0.047 0.038 0.030 30 0.026 0.020 0.015. 40 0.008 0.005 0.004 50 0.002 0.00 0.001 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.024 0.012 0.003 0.001 5% 0.952 0.907 0.864 0.823 0.784. 0.746 0.677 0.645 0.614. 0.585 0.557 0.5300 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 17% 0.855 0.73 0.624. 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.1300 0.095 0.08 0.069 0.059 0.05 0.043 0.020 0.009 0.002 Percent 6% 7% 8%. 9% 0.943 0.935 0.926 0.917 0.890 0.873 0.857 0.842 0.840 0.816 0.794 0.772 0.792 0.763 0.735 0.708 0.747 0.713 0.68 0.650 0.705 0.666 0.630 0.596 0.665 0.623 0.583 0.547 0.627 0.582 0.540 0.502 0.592 0.544 0.500 0.4600 0.508 0.558 0.463 0.422 0.527 0.475 0.429 0.388 0.497 0.444 0.397 0.356 0.469 0.415 0.368 0.326 0.442 0.388 0.340 0.299 0.417 0.362 0.315 0.275 0.394 0.339 0.292 0.252 0.371 0.317 0.270 0.231 0.350 0.296 0.250 0.212 0.331 0.277 0.232 0.194. 0.312 0.258 0.215 0.178 0.233 0.184 0.146 0.075 0.174 0.131 0.099 0.097 0.067 0.046 0.032 0.054 0.034. 0.02 0.013 Percent 18% 19% 20% 25% 30% 0.847 0.840 0.833 0.800 0.769 0.718 0.706 0.694 0.640 0.592 0.609 0.593 0.579 0.512 0.455 0.515 0.499 0.482 0.410 0.350 0.437 0.419 0.402 0.328 0.269 0.370 0.352 0.335 0.262 0.207 0.314 0.296 0.279 0.210 0.159 0.266 0.249 0.233 0.168 0.123 0.225 0.209 0.194 0.134 0.094. 0.191 0.176 0.162 0.107 0.073 0.162 0.148 0.135 0.086 0.056 0.137 0.124 0.112 0.069 0.043 0.116 0.104. 0.093 0.055 0.033 0.099 0.088 0.078 0.044 0.025. 0.074 0.084 0.065 0.035 0.020 0.071 0.062 0.054 0.028 0.015 0.060 0.052 0.045 0.023 0.012 0.051 0.044 0.038 0.018 0.009 0.043 0.037 0.031 0.014. 0.007 0.037 0.031 0.026 0.012 0.005 0.016 0.013 0.010 0.004. 0.001 0.007 0.005 0.004. 0.001 0.001 0.00 0.001 10% 0.909 0.826 0.751 0.683 0.621 0.564. 0.513 0.467 0.424. 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 35% 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0.001 11% 12% 0.901 0.893 0.812 0.797 0.731 0.712 0.659 0.636 0.593 0.567 0.535 0.507 0.482 0.452 0.434 0.404 0.391 0.361 0.352 0.322 0.317 0.287 0.286 0.257 0.258 0.229 0.232 0.205 0.209 0.183 0.188 0.163 0.170 0.146 0.153 0.130 0.138 0.116 0.124 0.104. 0.074 0.059 0.044 0.033 0.015 0.011 0.005 0.003 50% 0.667 0.714 0.510 0.444 0.364. 0.296 0.260 0.198 0.186 0.132 0.088 0.133 0.095 0.059 0.068 0.039 0.048 0.026 0.035 0.017 0.025 0.012 0.018 0.008 0.013 0,005 0.009 0.003 0.002 0.006 0.005 0.002 0.003 0.001 0.002 0.001 0.002 0.001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts