Question: What is the primary difference between the leverage ratios we use in finance to judge a firm's financial performance (e.g., versus an industry average) and

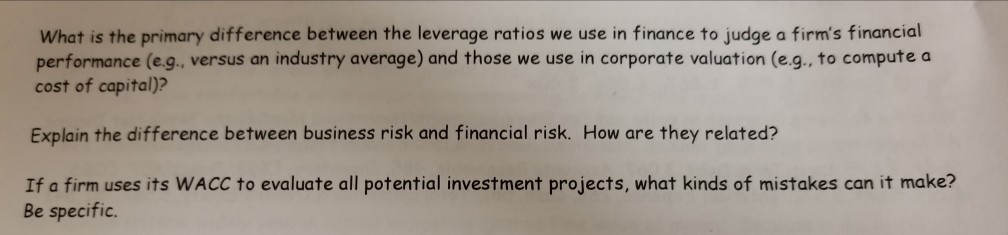

What is the primary difference between the leverage ratios we use in finance to judge a firm's financial performance (e.g., versus an industry average) and those we use in corporate valuation (e.g. to compute a cost of capital)? Explain the difference between business risk and financial risk. How are they related? If a firm uses its WACC to evaluate all potential investment projects, what kinds of mistakes can it make? Be specific

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts