Question: What is the required return for a stock with a beta of 1.1 ? The market return is 12% and the risk-free rate is 4%.

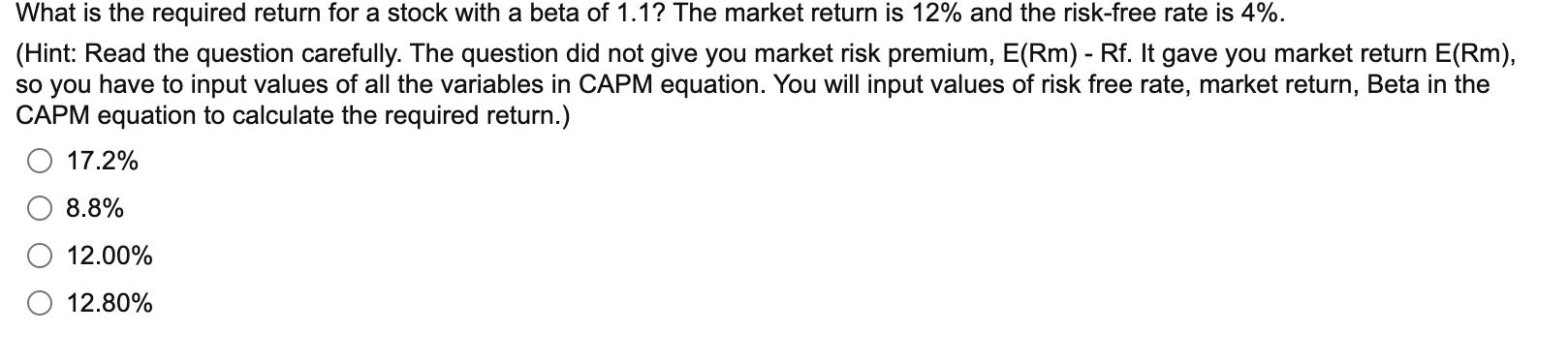

What is the required return for a stock with a beta of 1.1 ? The market return is 12% and the risk-free rate is 4%. (Hint: Read the question carefully. The question did not give you market risk premium, E(Rm) - Rf. It gave you market return E(Rm), so you have to input values of all the variables in CAPM equation. You will input values of risk free rate, market return, Beta in the CAPM equation to calculate the required return.) 17.2% 8.8% 12.00% 12.80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts