Question: What is the Return on Equity? (Please while you are solving the question, write net income, total operating income, noninterest expense, interest expense e.g.) Commerzbank

What is the Return on Equity? (Please while you are solving the question, write net income, total operating income, noninterest expense, interest expense e.g.)

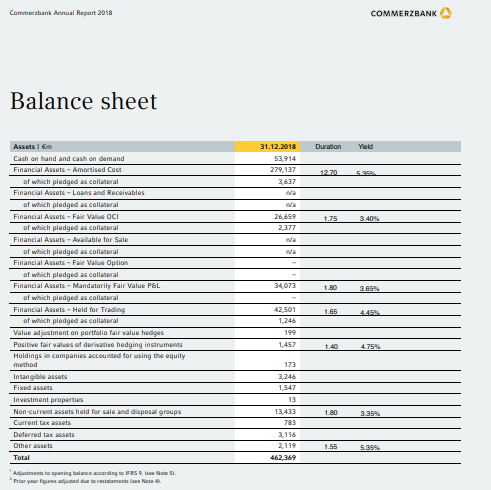

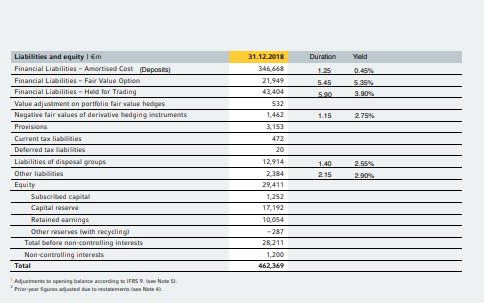

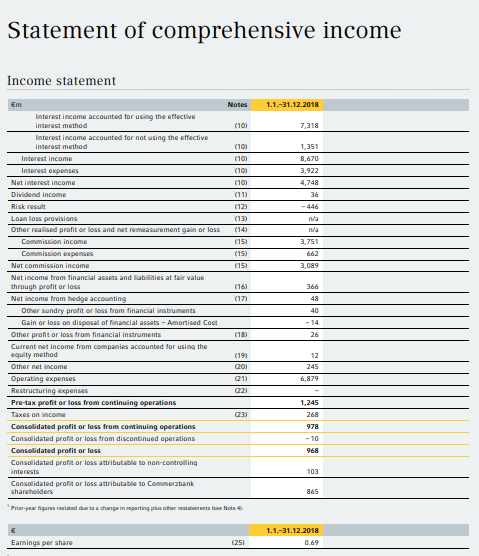

Commerzbank Annual Report 2018 COMMERZBANK Balance sheet Duration Yield 31.12.2013 53,914 279,137 3,637 1270 5.35 1.75 3.40% 26,659 2377 wa 34,073 1.80 3.65% Assets Em Cash on hand and cash on demand Financial Assets - Amortised Cost of which pledged as collateral Financial Assets - Loans and Receivables of which pledged as collateral Financial Assets - FairValue OCI of which pledged as collateral Financial Assets - Available for Sale of which pledged as collateral Financial Assets - Fair Value Option of which pledged as collateral Financial Assets - Mandatorily Fair Value PEL of which pledged as collateral Financial Assets - Held for Trading of which pledged as collateral Value adjustment on portfolio fair value hedges Positive fair values of derivative hedging instruments Holdings in companies accounted for using the equity method Intangible assets Fixed assets Investment properties Non-current assets hold for sale and disposal groups Current tax assets Deferred tax assets Other assets Total 42.501 1.246 1.65 4.45 199 1,457 140 173 3,246 1,547 13 13.433 783 3,116 2,119 462.369 1.80 1.55 55 Adatto pening balance according to IFRS. Ise Note 51. Prayer figures and due to Duration Weld 1.25 31.12.2018 346 668 21,949 43,404 0.45% 5.35% 5.45 5.00 3.90% 532 1,462 1.15 2.75% 3,153 472 20 Liabilities and equity I em Financial Liabilities - Amortised Cost Deposits Financial Liabilities - FairValue Option Financial Liabilities - Hold for Trading Value adjustment on portfolio fair value hedges Negative fair values of derivative hedging instruments Provisions Current tax liabilities Deferred tax abilities Liabilities of disposal groups Other liabilities Equity Subscribed capital Capital reserve Retained earnings Other reserves with recycling Total before non controlling interests Non-controlling interests Total 12,914 2.55% 1.40 2.15 2384 2.90 29,411 1.252 17,192 10,054 -287 28,211 1,200 462,369 Adjustments to opening balance actors. No Prior-year ressed due to rest 4 Statement of comprehensive income Income statement 1.1.-31.12.2018 7,318 1,351 8,670 3,922 4,748 36 -446 n/a n/a 3.751 662 3,089 (16) 366 Em Notes Interest income accounted for using the effective interest method (10) Interest income accounted for not using the effective interest method (100 Interest income (100 Interest expenses (10) Net interest income (100 Dividend income (11) Risk result (12) Loan loss provisions (13) Other realised profit or loss and netre measurement gain or loss (14) Commission income (15) Commission expenses (15) Net commission income (15) Net income from financial assets and liabilities at fair value through profit or loss Net income from hedge accounting (17) Other sundry profit or less from financial instruments Gain or loss on disposal of financial assets - Amortised Cost Other profit or loss from financial instruments Current net income from companies accounted for using the equity method (19) Other net income 201 Operating expenses (21) (22) Restructuring expenses Pre-tax profit or loss from continuing operations Taxes on income Consolidated profit or loss from continuing operations Consolidated profit or loss from discontinued operations Consolidated profit or loss Consolidated profit or loss attributable to non-controlling interests Consolidated profit or loss attributable to Commerzbank shareholders Prioryaw figures restated to change in reporting plus other statements Note 48 40 26 12 245 6,879 1,245 268 978 -10 968 103 865 1.1.-31.12.2018 Earnings per share (251 0.69 Commerzbank Annual Report 2018 COMMERZBANK Balance sheet Duration Yield 31.12.2013 53,914 279,137 3,637 1270 5.35 1.75 3.40% 26,659 2377 wa 34,073 1.80 3.65% Assets Em Cash on hand and cash on demand Financial Assets - Amortised Cost of which pledged as collateral Financial Assets - Loans and Receivables of which pledged as collateral Financial Assets - FairValue OCI of which pledged as collateral Financial Assets - Available for Sale of which pledged as collateral Financial Assets - Fair Value Option of which pledged as collateral Financial Assets - Mandatorily Fair Value PEL of which pledged as collateral Financial Assets - Held for Trading of which pledged as collateral Value adjustment on portfolio fair value hedges Positive fair values of derivative hedging instruments Holdings in companies accounted for using the equity method Intangible assets Fixed assets Investment properties Non-current assets hold for sale and disposal groups Current tax assets Deferred tax assets Other assets Total 42.501 1.246 1.65 4.45 199 1,457 140 173 3,246 1,547 13 13.433 783 3,116 2,119 462.369 1.80 1.55 55 Adatto pening balance according to IFRS. Ise Note 51. Prayer figures and due to Duration Weld 1.25 31.12.2018 346 668 21,949 43,404 0.45% 5.35% 5.45 5.00 3.90% 532 1,462 1.15 2.75% 3,153 472 20 Liabilities and equity I em Financial Liabilities - Amortised Cost Deposits Financial Liabilities - FairValue Option Financial Liabilities - Hold for Trading Value adjustment on portfolio fair value hedges Negative fair values of derivative hedging instruments Provisions Current tax liabilities Deferred tax abilities Liabilities of disposal groups Other liabilities Equity Subscribed capital Capital reserve Retained earnings Other reserves with recycling Total before non controlling interests Non-controlling interests Total 12,914 2.55% 1.40 2.15 2384 2.90 29,411 1.252 17,192 10,054 -287 28,211 1,200 462,369 Adjustments to opening balance actors. No Prior-year ressed due to rest 4 Statement of comprehensive income Income statement 1.1.-31.12.2018 7,318 1,351 8,670 3,922 4,748 36 -446 n/a n/a 3.751 662 3,089 (16) 366 Em Notes Interest income accounted for using the effective interest method (10) Interest income accounted for not using the effective interest method (100 Interest income (100 Interest expenses (10) Net interest income (100 Dividend income (11) Risk result (12) Loan loss provisions (13) Other realised profit or loss and netre measurement gain or loss (14) Commission income (15) Commission expenses (15) Net commission income (15) Net income from financial assets and liabilities at fair value through profit or loss Net income from hedge accounting (17) Other sundry profit or less from financial instruments Gain or loss on disposal of financial assets - Amortised Cost Other profit or loss from financial instruments Current net income from companies accounted for using the equity method (19) Other net income 201 Operating expenses (21) (22) Restructuring expenses Pre-tax profit or loss from continuing operations Taxes on income Consolidated profit or loss from continuing operations Consolidated profit or loss from discontinued operations Consolidated profit or loss Consolidated profit or loss attributable to non-controlling interests Consolidated profit or loss attributable to Commerzbank shareholders Prioryaw figures restated to change in reporting plus other statements Note 48 40 26 12 245 6,879 1,245 268 978 -10 968 103 865 1.1.-31.12.2018 Earnings per share (251 0.69

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts