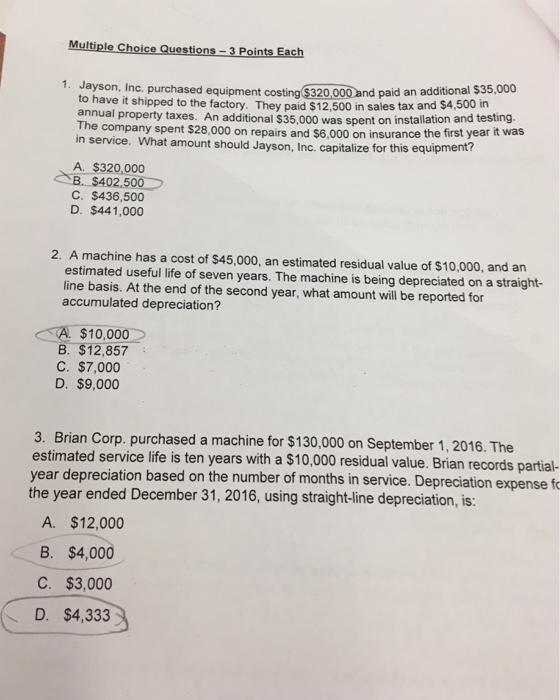

Question: What is the right answer????? Multiple choice Questions-3 Points Each 1. Jayson, Inc. purchased equipment costing S320.000 nd paid an additional $35,000 to have it

What is the right answer?????

What is the right answer????? Multiple choice Questions-3 Points Each 1. Jayson, Inc. purchased equipment costing S320.000 nd paid an additional $35,000 to have it shipped to the factory. They paid S12.500 in tax and S4.500 in annual property taxes. An additional $35,000 was spent on installation and testing The company spent $28.000 repairs and it was in service. should $6,000 on insurance the first year What amount Jayson, Inc. capitalize for equipment? this A. $320,000 402,500 C. $436,500 D. $441,000 2. A machine has a cost of $45,000, an estimated residual value of s10,000, and an estimated useful life of seven years. The machine being depreciated on a straight- basis. At the end of the second year, what amount will be reported for accumulated depreciation? A $10.00 B. $12,857 C. $7,000 D. $9,000 3. Corp. purchased a machine for $130,000 on September 1, 2016. The estimated service life is ten years with a $10,000 residual value. Brian records year depreciation based on the number of months in service. Depreciation expense fo the year ended December 31, 2016, using straight-line depreciation, is: A. $12,000 B. $4,000 C. $3,000 D. $4,333

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts