Question: What is the ROE (Return on Equity) using DuPont Analysis for cosmetics companies (example Splash Corporation in the Philippines)? Please give me the website and

What is the ROE (Return on Equity) using DuPont Analysis for cosmetics companies (example Splash Corporation in the Philippines)? Please give me the website and or sources. thanks!

Please give me the website and or sources. thanks!

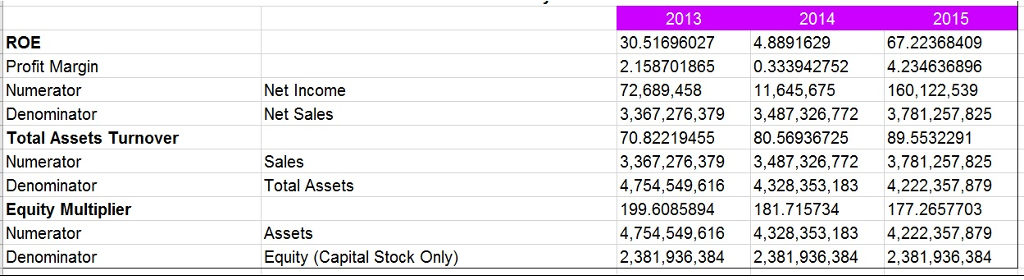

ROE Profit Margin Numerator Denominator Total Assets Turnover Numerator Denominator Equity Multiplier Numerator Denominator 2014 2013 2015 67.22368409 30.51696027 4.8891629 2.158701865 0.333942752 4.234636896 11,645,675 72,689,458 160,122,539 Net Income 3,367,276,379 3,487,326,772 3,781,257,825 Net Sales 70.82219455 80.56936725 89.5532291 Sales 3,367,276,379 3,487,326,772 3,781,257,825 4,754,549,616 4,328,353,183 4,222,357,879 Total Assets 199.6085894 181.715734 177.2657703 4,754,549,616 4,328,353,183 4,222,357,879 Assets (Capital stock only) 2,381,936,384 2,381,936,384 2,381,936,384 Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts