Question: What is the solution for these problems with the work shown? covered interest arbitrage (CIA) profit. 5. Toshi Numata (CS Tokyo) observes that the WS

What is the solution for these problems with the work shown?

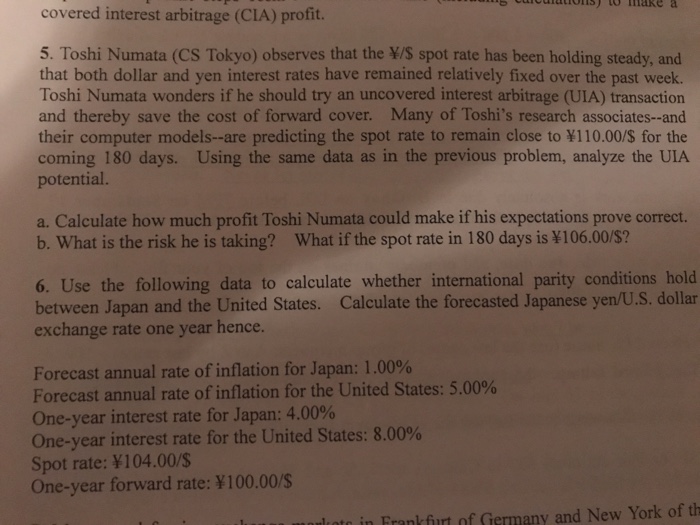

What is the solution for these problems with the work shown? covered interest arbitrage (CIA) profit. 5. Toshi Numata (CS Tokyo) observes that the WS spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Toshi Numata wonders if he should try an uncovered interest arbitrage (UIA) transaction and thereby save the cost of forward cover. Many of Toshi's research associates--and their computer models-are predicting the spot rate to remain close to 110.00/S for the coming 180 days. Using the same data as in the previous problem, analyze the UIA potential a. Calculate how much profit Toshi Numata could make if his expectations prove correct. b. What is the risk he is taking? What if the spot rate in 180 days is 106.00/S? 6. Use the following data to calculate whether international parity conditions hold between Japan and the United States. Calculate the forecasted Japanese yen/U.S. dollar exchange rate one year hence Forecast annual rate of inflation for Japan: 1.00% Forecast annual rate of inflation for the United States: 5.00% One-year interest rate for Japan: 4.00% One-year interest rate for the United States: 8.00% Spot rate: 104.00/$ One-year forward rate: 100.00/S lrotc in Frank fiurt of Germany and New York of th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts