Question: What is the solution for this Mini Case. Thanks. Poule Dorondoo Polo * The y as the way he has the highest ched by the

What is the solution for this Mini Case. Thanks.

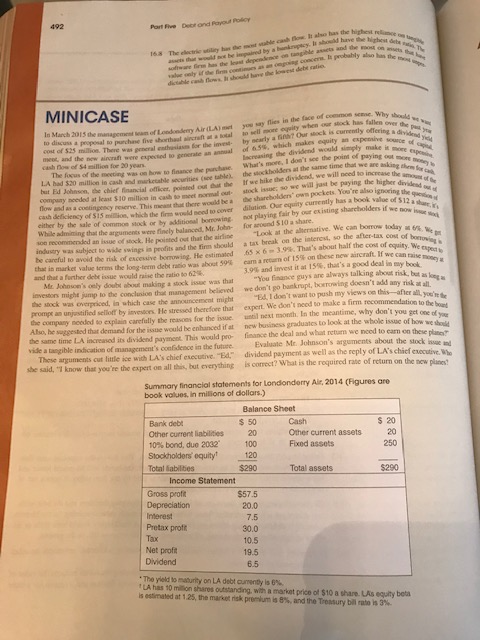

Poule Dorondoo Polo * The y as the way he has the highest ched by the bad have the the dependence a nd the concerne probably MINICASE he sed to increase them of 512 wew e 2015 them y e lhallen to discuss a proposal to purchase the shorthal l Cucks coccidit out of St y yy 55 milThe . There w e & which makes equity expensive s i de and the new awf u l e dividw l y make cash Dowe S4 million for 20 years p o pay The focus of the moon was What's more, do ho w finance thes e million in case but Johnson, the chief financial officer, posted If we hile the dividend we will send since chier nancial officer, pointed out that the company needed at least $10 million inch to normal out sack issues we will just be paying the higher s e This da i gency pocker s the sharehold cash deficiency of S15 min which the firm would need to cover e currently has a book va n either by the sale of common stock or by additional borrowing not playing fair by our existing shareholders if we whe admin that the ther ford 50 share son recommended an issue of stock. He t out that the airline the alternative. We can borrow today w industry was subject to wide wings in profits and their should a tax bre break on the interes, so the after las cost of bon be careful to avoid the risk of excessive borrowing. He estimated 656 - 3.99. That's about half the cost of equity. We in market value for the long-term dcben was het 594 ama of on the cat we can and that a further debe issue would raise the ratio 062 30% and investit 15%, that's a good deal in my boek Me Johnson's only doubt about making a shock issue was that "You flance guys are always talking wboot risk. butas investors might jump to the concluice that m oment beld we don't go bankrupt, borowing doesn't add any risk the stock was overiod, in which case the announcement might I don't want to push my views on this after all prompt an unjustified sellot by investors. He stressed therefore that expert. We don't need to make a firm recommendation to the the company needed to explain carefully the reasons for the we ntil next month. In the meantime, why don't you get Also, he sapested that demand for the issue would be enhanced if at new business graduates to look at the whole issue of how we the same time LA increased its dividend payment. This would pro finance the deal and what retum we need to cam on these vide a tangible indication of management's cofidence in the future. Evaluate Mr. Johnson's arguments about the stock These arguments cut little ice with LAN chief executive "14" dividend payment as well as the reply of LA's chief executive she said, "I know that you're the expert on all this, but everything is correct? What is the required rate of return on the new can Summary financial statements for Londonderry Ale 2014 (Figures are book values. In millions of dollars.) Cash S 20 20 250 $290 Balance Sheet Bank debt $ 50 Other current liabilities 20 Other current assets 10% bond, due 2032 100 Fixed assets Stockholders' equityt 120 Total abilities $290 Total assets Income Statement Gross profit $57.5 Depreciation 20.0 Interest 7.5 Pretax proft 30.0 Tax 10.5 Net profit Dividend 19.5 The yield to maturity on LA debt current is LA has 10 milion shares outstanding with a market price of $10 a share. As uity beta istimated at 125, the market risk premium is 8%, and the Treasury bili s 3% Poule Dorondoo Polo * The y as the way he has the highest ched by the bad have the the dependence a nd the concerne probably MINICASE he sed to increase them of 512 wew e 2015 them y e lhallen to discuss a proposal to purchase the shorthal l Cucks coccidit out of St y yy 55 milThe . There w e & which makes equity expensive s i de and the new awf u l e dividw l y make cash Dowe S4 million for 20 years p o pay The focus of the moon was What's more, do ho w finance thes e million in case but Johnson, the chief financial officer, posted If we hile the dividend we will send since chier nancial officer, pointed out that the company needed at least $10 million inch to normal out sack issues we will just be paying the higher s e This da i gency pocker s the sharehold cash deficiency of S15 min which the firm would need to cover e currently has a book va n either by the sale of common stock or by additional borrowing not playing fair by our existing shareholders if we whe admin that the ther ford 50 share son recommended an issue of stock. He t out that the airline the alternative. We can borrow today w industry was subject to wide wings in profits and their should a tax bre break on the interes, so the after las cost of bon be careful to avoid the risk of excessive borrowing. He estimated 656 - 3.99. That's about half the cost of equity. We in market value for the long-term dcben was het 594 ama of on the cat we can and that a further debe issue would raise the ratio 062 30% and investit 15%, that's a good deal in my boek Me Johnson's only doubt about making a shock issue was that "You flance guys are always talking wboot risk. butas investors might jump to the concluice that m oment beld we don't go bankrupt, borowing doesn't add any risk the stock was overiod, in which case the announcement might I don't want to push my views on this after all prompt an unjustified sellot by investors. He stressed therefore that expert. We don't need to make a firm recommendation to the the company needed to explain carefully the reasons for the we ntil next month. In the meantime, why don't you get Also, he sapested that demand for the issue would be enhanced if at new business graduates to look at the whole issue of how we the same time LA increased its dividend payment. This would pro finance the deal and what retum we need to cam on these vide a tangible indication of management's cofidence in the future. Evaluate Mr. Johnson's arguments about the stock These arguments cut little ice with LAN chief executive "14" dividend payment as well as the reply of LA's chief executive she said, "I know that you're the expert on all this, but everything is correct? What is the required rate of return on the new can Summary financial statements for Londonderry Ale 2014 (Figures are book values. In millions of dollars.) Cash S 20 20 250 $290 Balance Sheet Bank debt $ 50 Other current liabilities 20 Other current assets 10% bond, due 2032 100 Fixed assets Stockholders' equityt 120 Total abilities $290 Total assets Income Statement Gross profit $57.5 Depreciation 20.0 Interest 7.5 Pretax proft 30.0 Tax 10.5 Net profit Dividend 19.5 The yield to maturity on LA debt current is LA has 10 milion shares outstanding with a market price of $10 a share. As uity beta istimated at 125, the market risk premium is 8%, and the Treasury bili s 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts