Question: What is the solution to this question? Please to help. Thank you. Question 45 a. Carbondale Inc., plans to construct a manufacturing plant in Mexico.

What is the solution to this question?

Please to help. Thank you.

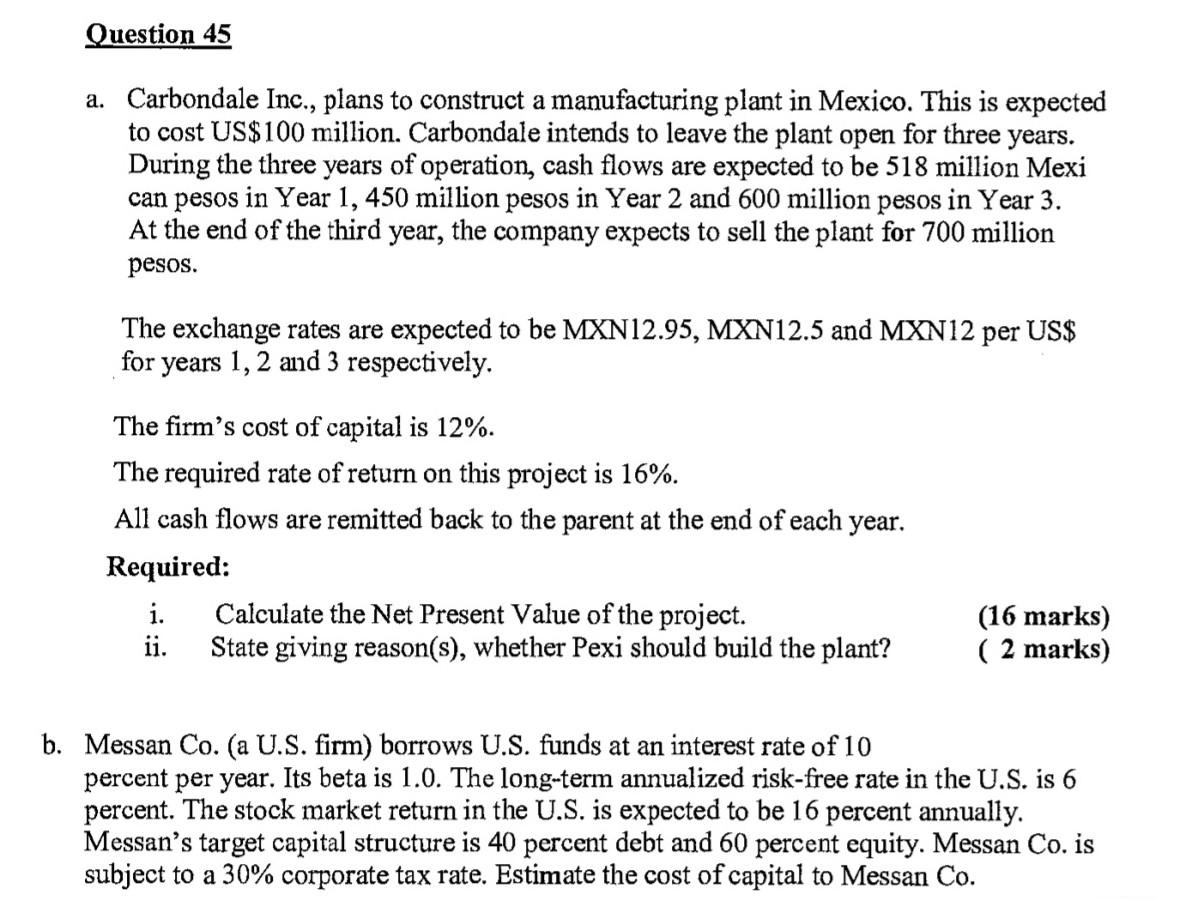

Question 45 a. Carbondale Inc., plans to construct a manufacturing plant in Mexico. This is expected to cost US$ 100 million. Carbondale intends to leave the plant open for three years. During the three years of operation, cash flows are expected to be 518 million Mexi can pesos in Year 1, 450 million pesos in Year 2 and 600 million pesos in Year 3. At the end of the third year, the company expects to sell the plant for 700 million pesos. The exchange rates are expected to be MXN12.95, MXN12.5 and MXN12 per US$ for years 1, 2 and 3 respectively. The firm's cost of capital is 12%. The required rate of return on this project is 16%. All cash flows are remitted back to the parent at the end of each year. Required: i. Calculate the Net Present Value of the project. ii. State giving reason(s), whether Pexi should build the plant? (16 marks) ( 2 marks) b. Messan Co. (a U.S. firm) borrows U.S. funds at an interest rate of 10 percent per year. Its beta is 1.0. The long-term annualized risk-free rate in the U.S. is 6 percent. The stock market return in the U.S. is expected to be 16 percent annually. Messan's target capital structure is 40 percent debt and 60 percent equity. Messan Co. is subject to a 30% corporate tax rate. Estimate the cost of capital to Messan Co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts