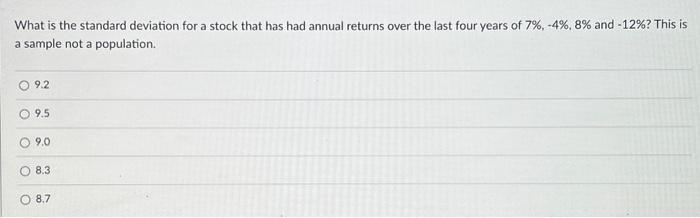

Question: What is the standard deviation for a stock that has had annual returns over the last four years of 7%,4%,8% and 12%? This is a

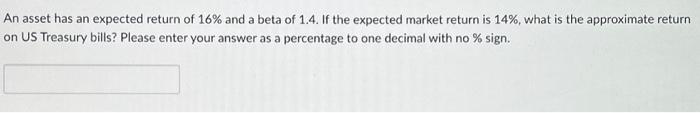

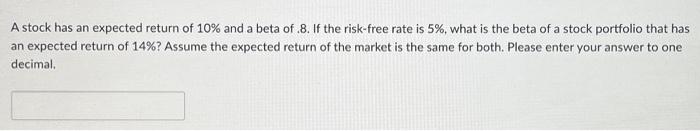

What is the standard deviation for a stock that has had annual returns over the last four years of 7%,4%,8% and 12%? This is a sample not a population. 9.2 9.5 9.0 8.3 8.7 An asset has an expected return of 16% and a beta of 1.4 . If the expected market return is 14%, what is the approximate return on US Treasury bills? Please enter your answer as a percentage to one decimal with no % sign. A stock has an expected return of 10% and a beta of .8 . If the risk-free rate is 5%, what is the beta of a stock portfolio that has an expected return of 14% ? Assume the expected return of the market is the same for both. Please enter your answer to one decimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts