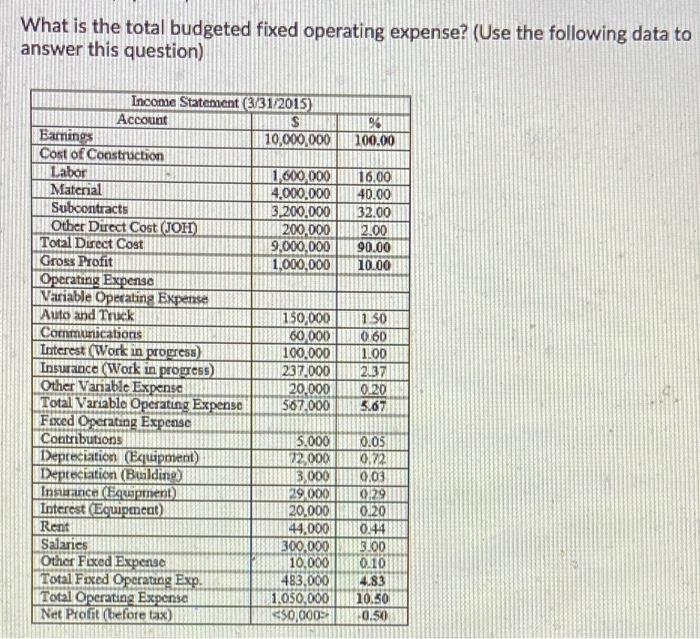

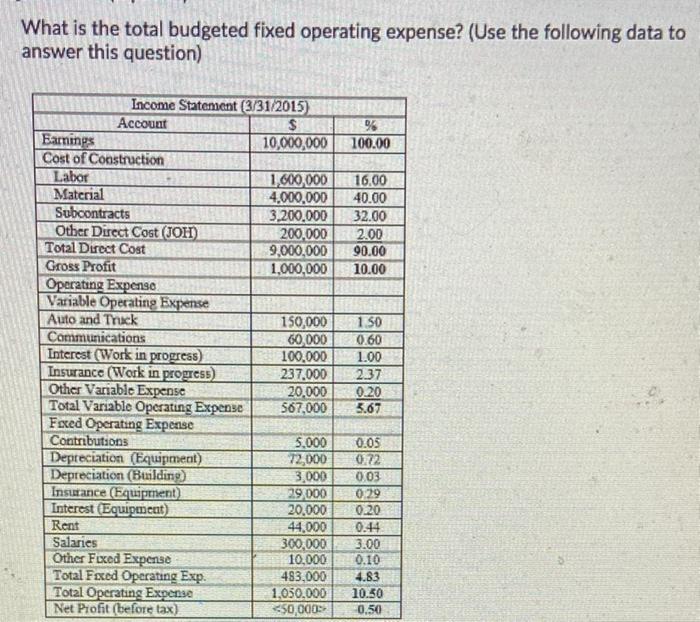

Question: What is the total budgeted fixed operating expense? (Use the following data to answer this question) 9 100.00 16.00 40.00 32.00 2.00 90.00 10.00 Income

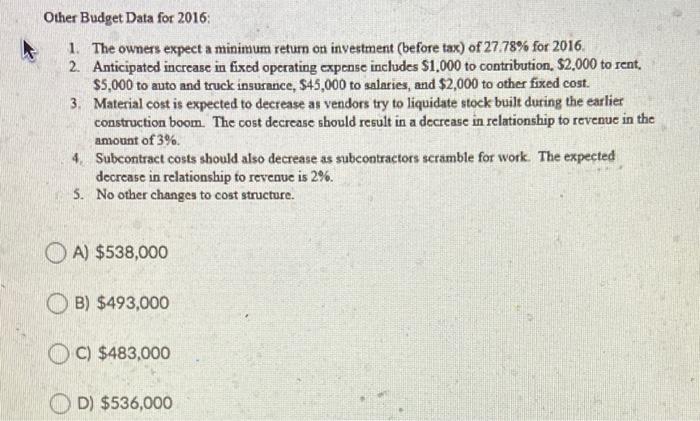

What is the total budgeted fixed operating expense? (Use the following data to answer this question) 9 100.00 16.00 40.00 32.00 2.00 90.00 10.00 Income Statement (3/31/2015) Account $ Earnings 10,000,000 Cost of Construction Labor 1,600,000 Material 4.000.000 Subcontracts 13.200.000 Other Direct Cost (JOH) 200.000 Total Direct Cost 9,000,000 Gross Profit 1,000,000 Operating Expense Variable Operating Expense Auto and Truck 150,000 Communications 60.000 Interest (Work in progress) 100,000 Insurance (Work in progress) 237,000 Other Vanable Expense 20,000 Total Variable Operating Expenso 567.000 Fixed Operating Expense Contributions 5.000 Depreciation (Equipment) 72.000 Depreciation (Building) Insurance Equipment) 29 000 Interest (Equipment) 20.000 Rent 144.000 Salaries 300.000 Other Fixed Expense 10,000 Total Fixed Operating Exp. 483,000 Total Operating Expense 1.050,000 Net Profit (before tax) 250,000 130 0.60 1.00 2.37 0.20 5.67 3,000 0.05 0.72 0.03 0,29 0.20 0.44 3.00 0.10 4.83 10.50 0.50 What is the total budgeted fixed operating expense? (Use the following data to answer this question) 100.00 16.00 40.00 32.00 2.00 90.00 10.00 Income Statement (3/31/2015) Account $ Earnings 10,000,000 Cost of Construction Labor 1,000,000 Material 4.000.000 Subcontracts 3.200.000 Other Direct Cost (DOH) 200,000 Total Direct Cost 9,000,000 Gross Profit 1,000,000 Operating Expenso Variable Operating Expense Auto and Track 150,000 Communications 60,000 Interest (Work in progress) 100.000 Insurance (Work in progress) 237,000 Other Variable Expense 20.000 Total Variable Operating Expense 567,000 Feed Operating Expense Contributions 5.000 Depreciation (Equipment) 72,000 Depreciation (Building) 3,000 Insurance (Equipment) 29 000 Interest (Equipment) 20,000 Rent 44,000 Salaries 300,000 Other Fixed Expense 10,000 Total Fixed Operating Exp. 483,000 Total Operating Expense 1,050,000 Net Profit (before tax) 350,000 1.50 0.60 1.00 2.37 0.20 5.67 0.05 0.22 0.03 0.29 0.20 0.44 3.00 0.10 4.83 10.50 0,50 Other Budget Data for 2016: 1. The owners expect a minimum return on investment (before tax) of 27.78% for 2016, 2. Anticipated increase in fixed operating expense includes $1,000 to contribution, $2,000 to rent. $5,000 to auto and truck insurance, $45,000 to salaries, and $2,000 to other fixed cost. 3. Material cost is expected to decrease as vendors try to liquidate stock built during the earlier construction boom. The cost decrease should result in a decrease in relationship to revenue in the amount of 3%. 4. Subcontract costs should also decrease as subcontractors scramble for work. The expected decrease in relationship to revenue is 2%. 5. No other changes to cost structure. A) $538,000 OB) $493,000 O c) $483,000 OD) $536,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts