Question: What is the total return for a 20-year zero-coupon bond that is offering a yield to maturity of 8% if the bond is held

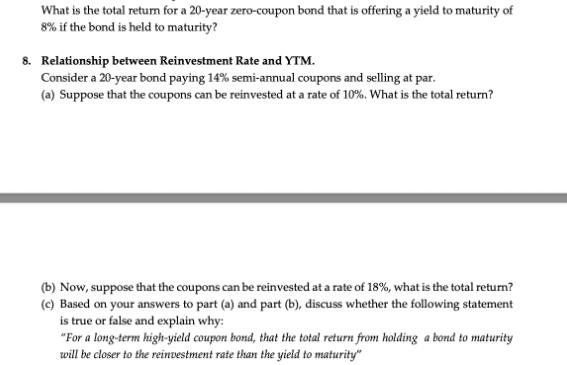

What is the total return for a 20-year zero-coupon bond that is offering a yield to maturity of 8% if the bond is held to maturity? 8. Relationship between Reinvestment Rate and YTM. Consider a 20-year bond paying 14% semi-annual coupons and selling at par. (a) Suppose that the coupons can be reinvested at a rate of 10%. What is the total return? (b) Now, suppose that the coupons can be reinvested at a rate of 18%, what is the total return? (c) Based on your answers to part (a) and part (b), discuss whether the following statement is true or false and explain why: "For a long-term high-yield coupon bond, that the total return from holding a bond to maturity will be closer to the reinvestment rate than the yield to maturity"

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Lets calculate the total return for the 20year zerocoupon bond A zerocoupon bond doesnt pay periodic ... View full answer

Get step-by-step solutions from verified subject matter experts