Question: What is the WACC using divinded model? Stephed Limited's current capital structure consists of bonds with a Face Value of 12M with coupon payments are

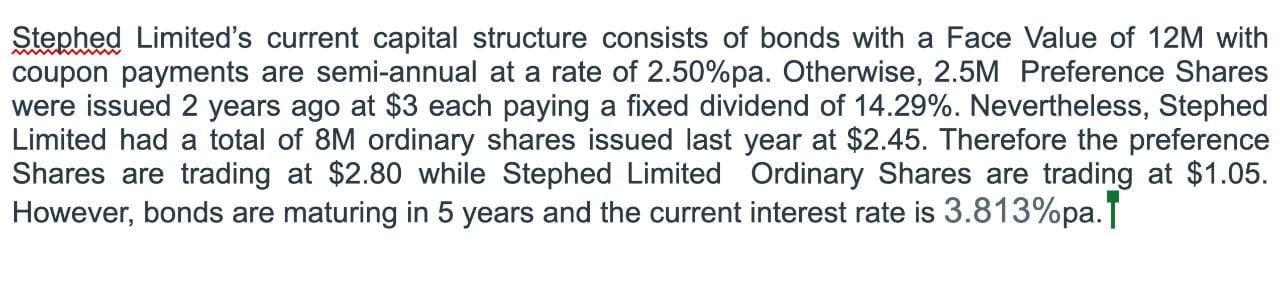

Stephed Limited's current capital structure consists of bonds with a Face Value of 12M with coupon payments are semi-annual at a rate of 2.50%pa. Otherwise, 2.5M Preference Shares were issued 2 years ago at $3 each paying a fixed dividend of 14.29%. Nevertheless, Stephed Limited had a total of 8M ordinary shares issued last year at $2.45. Therefore the preference Shares are trading at $2.80 while Stephed Limited Ordinary Shares are trading at $1.05. However, bonds are maturing in 5 years and the current interest rate is 3.813%pa.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

The WACC using the dividend model is ... View full answer

Get step-by-step solutions from verified subject matter experts