Question: what is the whole solution step by step Question 3: Yield Curve (20 points) You observe the following bonds in the market. Assume they are

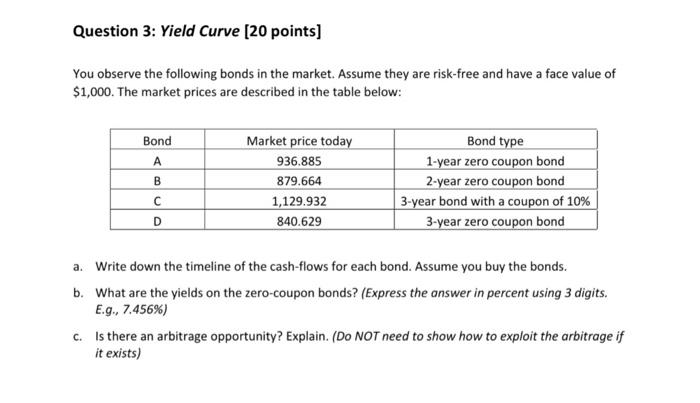

Question 3: Yield Curve (20 points) You observe the following bonds in the market. Assume they are risk-free and have a face value of $1,000. The market prices are described in the table below: Bond B Market price today 936.885 879.664 1,129.932 840.629 Bond type 1-year zero coupon bond 2-year zero coupon bond 3-year bond with a coupon of 10% 3-year zero coupon bond D a. Write down the timeline of the cash-flows for each bond. Assume you buy the bonds. b. What are the yields on the zero-coupon bonds? (Express the answer in percent using 3 digits. E.g., 7.456%) c. Is there an arbitrage opportunity? Explain. (Do NOT need to show how to exploit the arbitrage if it exists)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts