Question: what is the whole solution step by step Question 6: Portfolio Theory (10 points) Stock A has expected return of 26% and volatility 50%. Stock

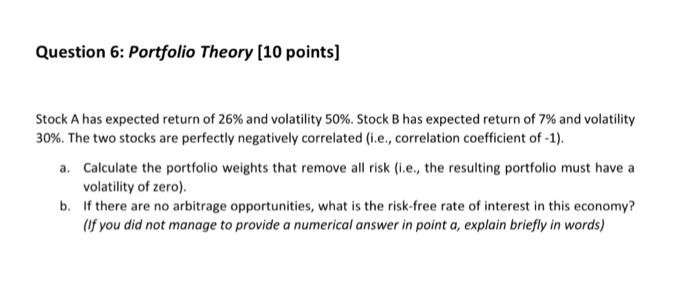

Question 6: Portfolio Theory (10 points) Stock A has expected return of 26% and volatility 50%. Stock Bhas expected return of 7% and volatility 30%. The two stocks are perfectly negatively correlated (i.e., correlation coefficient of -1). a. Calculate the portfolio weights that remove all risk (i.e, the resulting portfolio must have a volatility of zero). b. If there are no arbitrage opportunities, what is the risk-free rate of interest in this economy? (if you did not manage to provide a numerical answer in point a, explain briefly in words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts