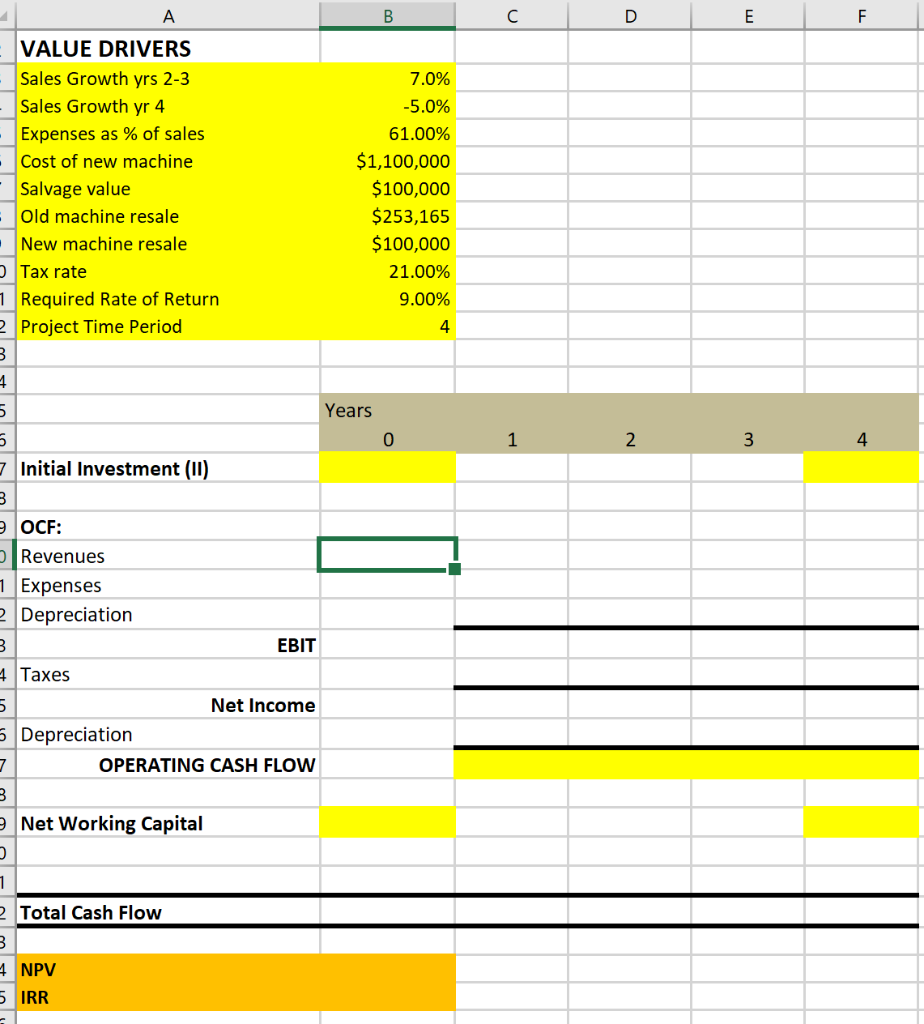

Question: What is the Year 3 Revenue ? DO NOT ENTER A DOLLAR SIGN What is the Year 2 Total Cash Flow? DO NOT ENTER A

What is the Year 3 Revenue? DO NOT ENTER A DOLLAR SIGN

What is the Year 2 Total Cash Flow? DO NOT ENTER A DOLLAR SIGN

What is the IRR of the project based on the revisions from the scenario analysis?

8.4

7.3

7.7

1.9

VALUE DRIVERS Sales Growth yrs 2-3 Sales Growth yr 4 Expenses as % of sales Cost of new machine Salvage value - Old machine resale New machine resale Tax rate 1 Required Rate of Return 2 Project Time Period 7.0% -5.0% 61.00% $1,100,000 $100,000 $253,165 $100,000 21.00% 9.00% 4 UI Years 5 0 1 2 3 4 7 Initial Investment (11) OCF: Revenues 1 Expenses 2 Depreciation EBIT 4 Taxes Net Income 5 Depreciation OPERATING CASH FLOW Net Working Capital 2 Total Cash Flow 3 4 NPV 5 IRR VALUE DRIVERS Sales Growth yrs 2-3 Sales Growth yr 4 Expenses as % of sales Cost of new machine Salvage value - Old machine resale New machine resale Tax rate 1 Required Rate of Return 2 Project Time Period 7.0% -5.0% 61.00% $1,100,000 $100,000 $253,165 $100,000 21.00% 9.00% 4 UI Years 5 0 1 2 3 4 7 Initial Investment (11) OCF: Revenues 1 Expenses 2 Depreciation EBIT 4 Taxes Net Income 5 Depreciation OPERATING CASH FLOW Net Working Capital 2 Total Cash Flow 3 4 NPV 5 IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts