Question: what is this answer? Lopez Plastics Co. (LPC) issued callable bonds on January 1, 2020. LPC's accountant has projected the following amortization schedule from issuance

what is this answer?

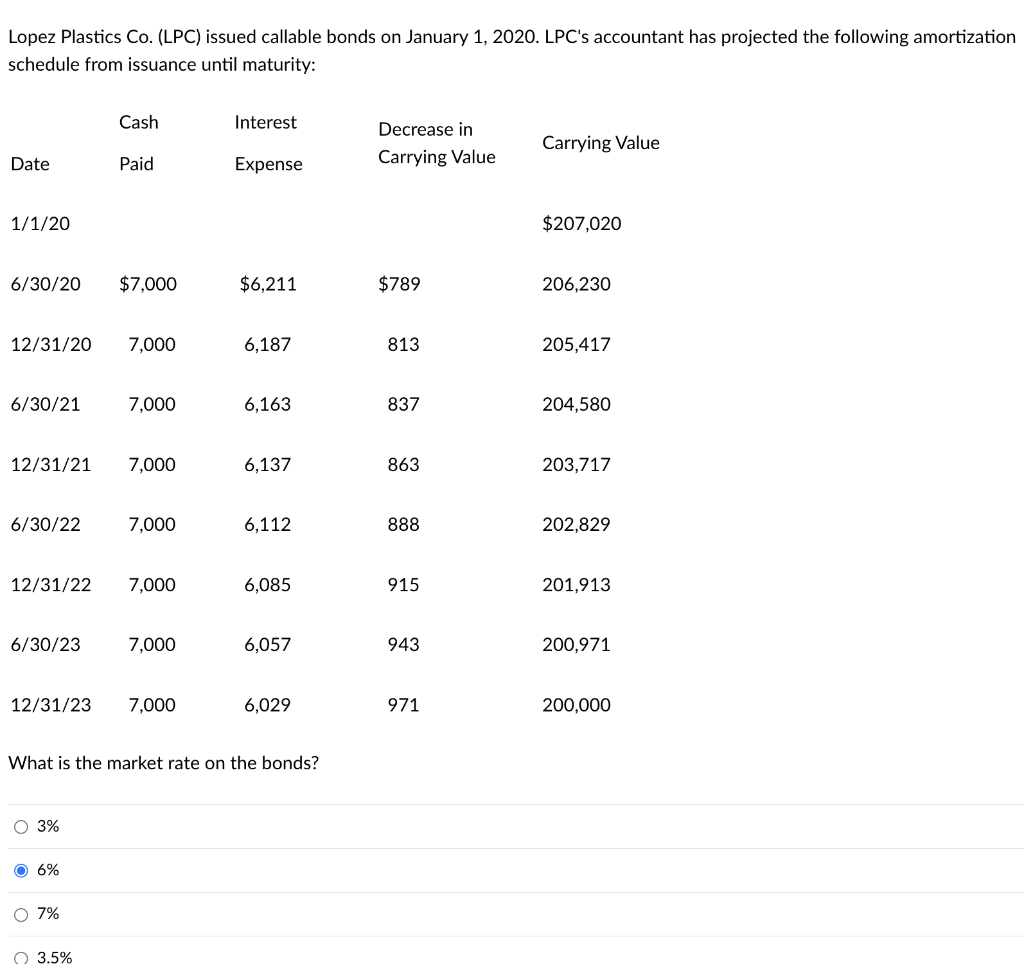

Lopez Plastics Co. (LPC) issued callable bonds on January 1, 2020. LPC's accountant has projected the following amortization schedule from issuance until maturity: Cash Interest Decrease in Carrying Value Carrying Value Date Paid Expense 1/1/20 $207,020 6/30/20 $7,000 $6,211 $789 206,230 12/31/20 7,000 6,187 813 205,417 6/30/21 7,000 6,163 837 204,580 12/31/21 7,000 6,137 863 203,717 6/30/22 7,000 6,112 888 202,829 12/31/22 7,000 6,085 915 201,913 6/30/23 7,000 6,057 943 200,971 12/31/23 7,000 6,029 971 200,000 What is the market rate on the bonds? O 3% O 6% O 7% O 3.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts