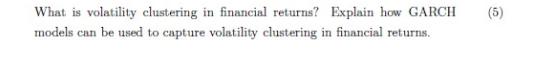

Question: What is volatility clustering in financial returns? Explain how GARCH models can be used to capture volatility clustering in financial returns. (5) (b) Let

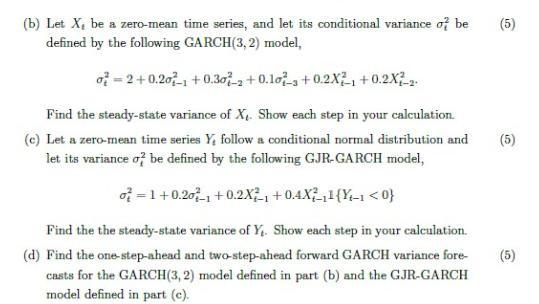

What is volatility clustering in financial returns? Explain how GARCH models can be used to capture volatility clustering in financial returns. (5) (b) Let X, be a zero-mean time series, and let its conditional variance of be defined by the following GARCH (3, 2) model, o=2+0.201 +0.30-2 +0.10+ 0.2X +0.2X2-2 Find the steady-state variance of X. Show each step in your calculation. (c) Let a zero-mean time series Y, follow a conditional normal distribution and let its variance of be defined by the following GJR-GARCH model, o=1+0.201 +0.2X1+0.4X11(Y-1

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

a Volatility clustering refers to the tendency for large changes in a financial time series returns ... View full answer

Get step-by-step solutions from verified subject matter experts