Question: - What is WACC? How do we calculate it? How does leverage influence the cost of equity, cost of debt and WACC? - What are

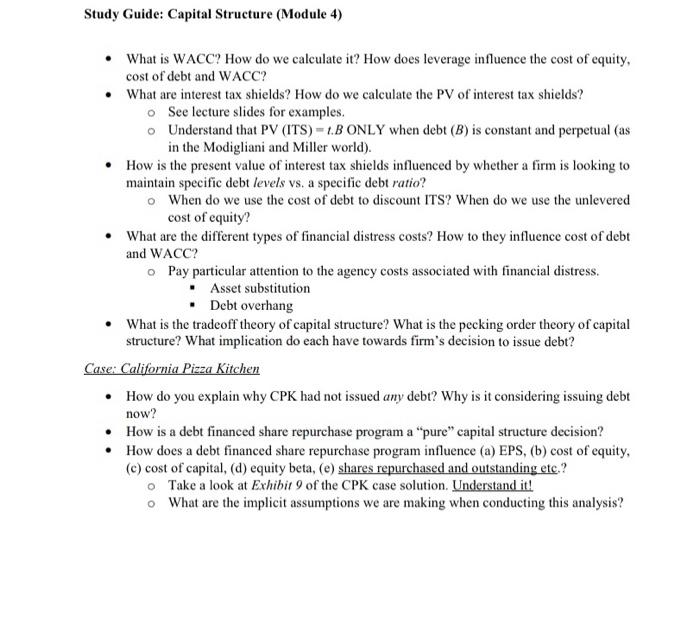

- What is WACC? How do we calculate it? How does leverage influence the cost of equity, cost of debt and WACC? - What are interest tax shields? How do we calculate the PV of interest tax shields? See lecture slides for examples. Understand that PV (ITS) =t.B ONLY when debt (B) is constant and perpetual (as in the Modigliani and Miller world). - How is the present value of interest tax shields influenced by whether a firm is looking to maintain specific debt levels vs. a specific debt ratio? - When do we use the cost of debt to discount ITS? When do we use the unlevered cost of equity? - What are the different types of financial distress costs? How to they influence cost of debt and WACC? - Pay particular attention to the agency costs associated with financial distress. - Asset substitution - Debt overhang - What is the tradeoff theory of capital structure? What is the pecking order theory of capital structure? What implication do each have towards firm's decision to issue debt? Case: California Pizza Kitchen - How do you explain why CPK had not issued any debt? Why is it considering issuing debt now? - How is a debt financed share repurchase program a "pure" capital structure decision? - How does a debt financed share repurchase program influence (a) EPS, (b) cost of equity, (c) cost of capital, (d) equity beta, (e) shares repurchased and outstanding etc.? Take a look at Exhibit 9 of the CPK case solution. Understand it! What are the implicit assumptions we are making when conducting this analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts