Question: what kind information do you need? EM9.6 Adjusting Entry Unearned Revenue Complete the following adjusting entry for Mookie The Beagle Concierge. On January 14,2023 ,

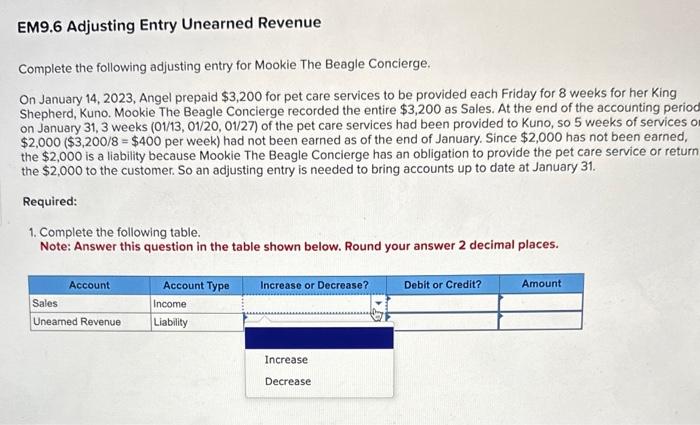

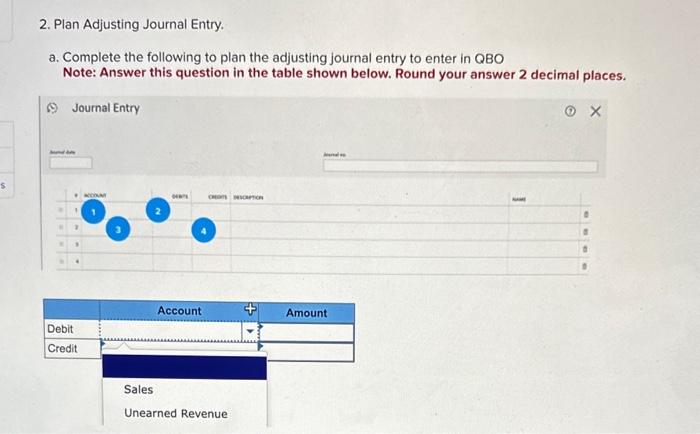

EM9.6 Adjusting Entry Unearned Revenue Complete the following adjusting entry for Mookie The Beagle Concierge. On January 14,2023 , Angel prepaid $3,200 for pet care services to be provided each Friday for 8 weeks for her King Shepherd, Kuno. Mookie The Beagle Concierge recorded the entire $3,200 as Sales. At the end of the accounting perioc on January 31,3 weeks (01/13,01/20,01/27) of the pet care services had been provided to Kuno, so 5 weeks of services o $2,000($3,200/8=$400 per week) had not been earned as of the end of January. Since $2,000 has not been earned, the $2,000 is a liability because Mookie The Beagle Concierge has an obligation to provide the pet care service or return the $2,000 to the customer. So an adjusting entry is needed to bring accounts up to date at January 31. Required: 1. Complete the following table. Note: Answer this question in the table shown below. Round your answer 2 decimal places. 2. Plan Adjusting Journal Entry. a. Complete the following to plan the adjusting journal entry to enter in QBO Note: Answer this question in the table shown below. Round your answer 2 decimal places. 9.) Journal Entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts