Question: What liquidity position is MicroSystems in? Select one: a. Poor close to standard benchmarks, but higher than industry competitor JB b. Poor close to standard

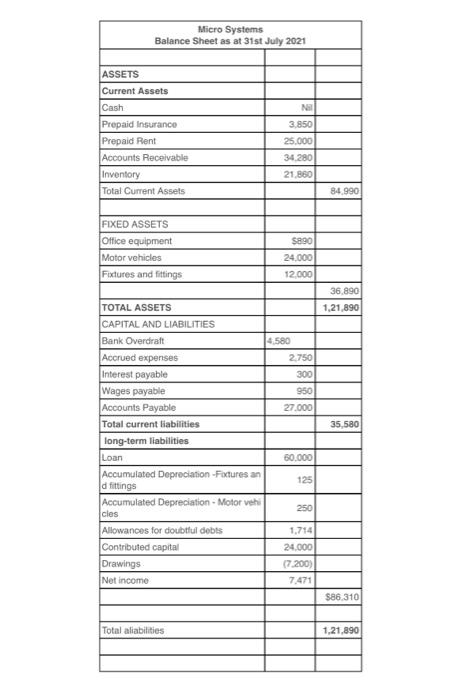

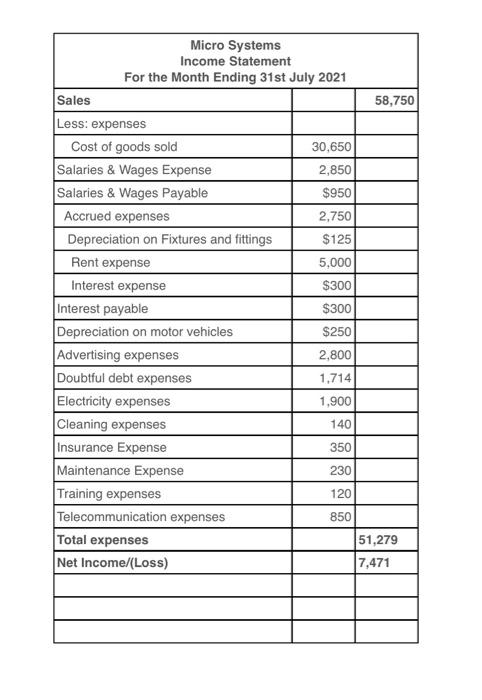

"What liquidity position is MicroSystems in?" Select one: a. Poor close to standard benchmarks, but higher than industry competitor JB b. Poor close to standard benchmarks, but lower than industry competitor JB O c. Good - close to standard benchmarks, and higher than industry competitor JB Od. Good close to standard benchmarks, and lower than industry competitor JB Micro Systems Balance Sheet as at 31st July 2021 Nil 3,850 25,000 34,280 21,860 $890 24,000 12,000 ASSETS Current Assets Cash Prepaid Insurance Prepaid Rent Accounts Receivable Inventory Total Current Assets FIXED ASSETS Office equipment Motor vehicles Fixtures and fittings TOTAL ASSETS CAPITAL AND LIABILITIES Bank Overdraft Accrued expenses Interest payable Wages payable Accounts Payable Total current liabilities long-term liabilities Loan Accumulated Depreciation -Fixtures an d fittings Accumulated Depreciation - Motor vehi cles Allowances for doubtful debts Contributed capital Drawings Net income Total aliabilities 4.580 2.750 300 950 27.000 60.000 125 250 1,714 24,000 (7.200) 7,471 84,990 36,890 1,21,890 35,580 $86.310 1,21,890 Micro Systems Income Statement For the Month Ending 31st July 2021 30,650 2,850 $950 2,750 $125 5,000 $300 $300 $250 2,800 1,714 1,900 140 350 230 120 850 Sales Less: expenses Cost of goods sold Salaries & Wages Expense Salaries & Wages Payable Accrued expenses Depreciation on Fixtures and fittings Rent expense Interest expense Interest payable Depreciation on motor vehicles. Advertising expenses Doubtful debt expenses Electricity expenses Cleaning expenses Insurance Expense Maintenance Expense Training expenses Telecommunication expenses Total expenses Net Income/(Loss) 58,750 51,279 7,471

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts