Question: What makes Gain on Disposal of Plant Assets negative/or decrease? I'm about to take a quiz on all of this material and not sure how

What makes Gain on Disposal of Plant Assets negative/or decrease? I'm about to take a quiz on all of this material and not sure how to find out how whether I need to make an amount negative (decrease) or positive (increase) in order to get the correct total amount.

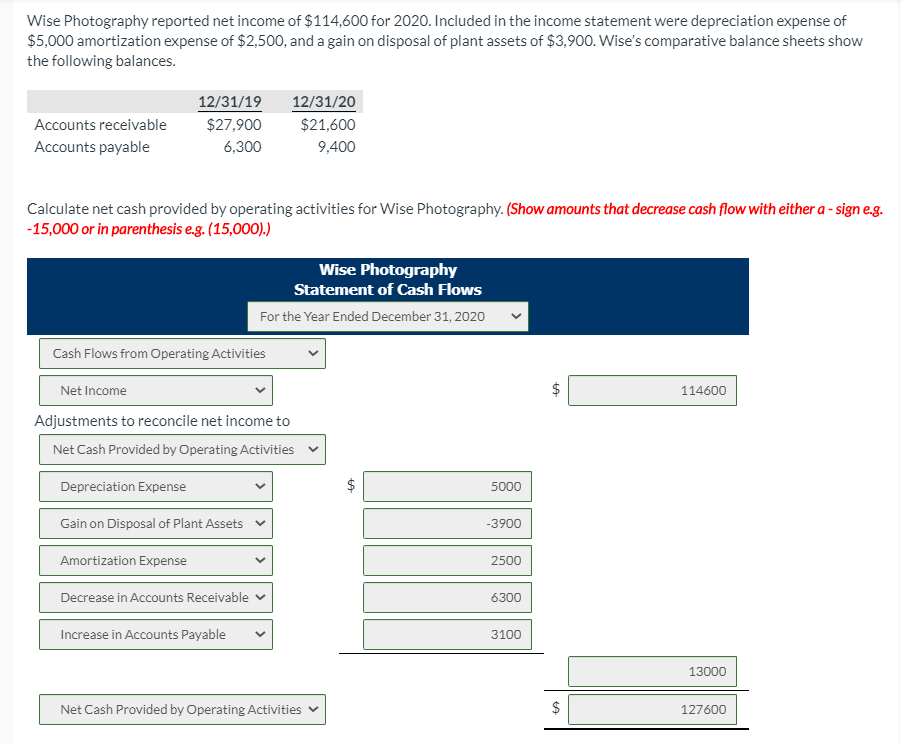

Wise Photography reported net income of $114,600 for 2020. Included in the income statement were depreciation expense of $5,000 amortization expense of $2,500, and a gain on disposal of plant assets of $3,900. Wise's comparative balance sheets show the following balances. Accounts receivable Accounts payable 12/31/19 $27,900 6,300 12/31/20 $21,600 9,400 Calculate net cash provided by operating activities for Wise Photography. (Show amounts that decrease cash flow with either a - signe.g. -15,000 or in parenthesis e.g. (15,000).) Wise Photography Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities $ 114600 Net Income Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense 5000 Gain on Disposal of Plant Assets -3900 Amortization Expense 2500 Decrease in Accounts Receivable 6300 Increase in Accounts Payable 3100 13000 Net Cash Provided by Operating Activities $ $ 127600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts