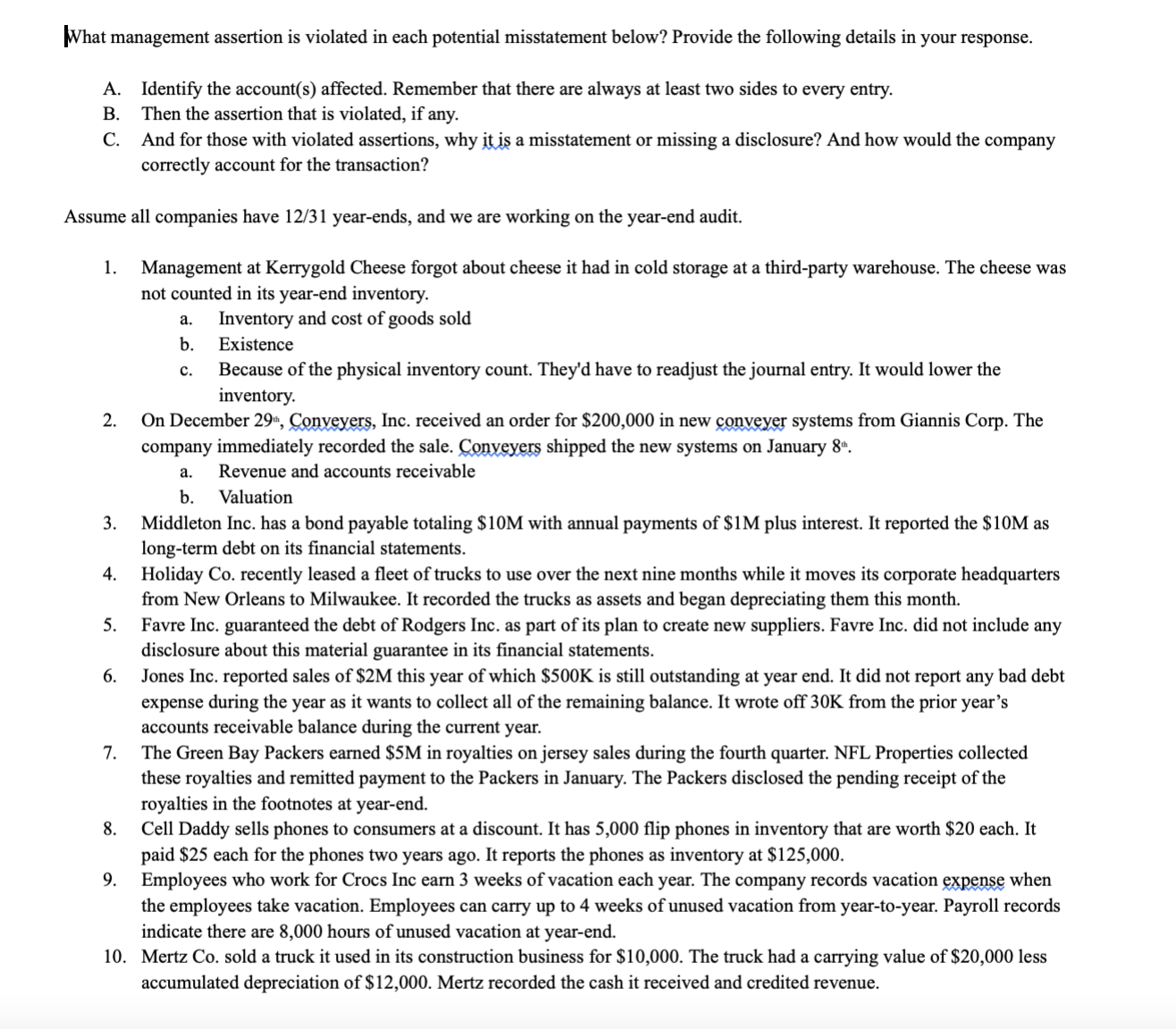

Question: What management assertion is violated in each potential misstatement below? Provide the following details in your response. A . Identify the account ( s )

What management assertion is violated in each potential misstatement below? Provide the following details in your response.

A Identify the accounts affected. Remember that there are always at least two sides to every entry.

B Then the assertion that is violated, if any.

C And for those with violated assertions, why it is a misstatement or missing a disclosure? And how would the company

correctly account for the transaction?

Assume all companies have yearends, and we are working on the yearend audit.

Management at Kerrygold Cheese forgot about cheese it had in cold storage at a thirdparty warehouse. The cheese was

not counted in its yearend inventory.

a Inventory and cost of goods sold

b Existence

c Because of the physical inventory count. They'd have to readjust the journal entry. It would lower the

inventory.

On December Conyeyers, Inc. received an order for $ in new conveyer systems from Giannis Corp. The

company immediately recorded the sale. Conyeyers shipped the new systems on January

a Revenue and accounts receivable

b Valuation

Middleton Inc. has a bond payable totaling $ with annual payments of $ plus interest. It reported the $ as

longterm debt on its financial statements.

Holiday Co recently leased a fleet of trucks to use over the next nine months while it moves its corporate headquarters

from New Orleans to Milwaukee. It recorded the trucks as assets and began depreciating them this month.

Favre Inc. guaranteed the debt of Rodgers Inc. as part of its plan to create new suppliers. Favre Inc. did not include any

disclosure about this material guarantee in its financial statements.

Jones Inc. reported sales of $ this year of which $ is still outstanding at year end. It did not report any bad debt

expense during the year as it wants to collect all of the remaining balance. It wrote off K from the prior year's

accounts receivable balance during the current year.

The Green Bay Packers earned $ in royalties on jersey sales during the fourth quarter. NFL Properties collected

these royalties and remitted payment to the Packers in January. The Packers disclosed the pending receipt of the

royalties in the footnotes at yearend.

Cell Daddy sells phones to consumers at a discount. It has flip phones in inventory that are worth $ each. It

paid $ each for the phones two years ago. It reports the phones as inventory at $

Employees who work for Crocs Inc earn weeks of vacation each year. The company records vacation expense when

the employees take vacation. Employees can carry up to weeks of unused vacation from yeartoyear. Payroll records

indicate there are hours of unused vacation at yearend.

Mertz Co sold a truck it used in its construction business for $ The truck had a carrying value of $ less

accumulated depreciation of $ Mertz recorded the cash it received and credited revenue.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock